Disrupting the status quo

I know that I can have what I want in life if I help other people get what they want. I choose to work with every single one of my clients because they’re people who believe what I believe.

Emotions are more important than intellect. We are more irrational than rational beings. In fact, science shows that if we were 100% rational beings, we never could have evolved as a species.

We make decisions consciously but act emotionally. It isn’t all about IQ: it’s also about mindset. And the best mindset for an investor is one that strikes the perfect balance between a contrarian thinker and a calculator.

🖂 Start the Conversation today

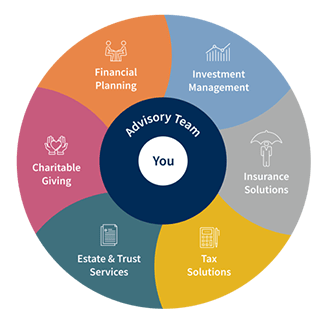

Total Wealth Solutions

Through our Total Wealth Solutions approach, we collaborate with you to help you reach your financial goals at every stage of life. Whether you’re planning for retirement, growing a business, or transferring wealth to the next generation, we create a cohesive strategy that provides the best solutions to fit your individual needs. Empower your wealth journey with personalized advice from our dedicated team of specialists that help incorporate;

- Financial Planning

- Investment Management

- Insurance Solutions

- Tax Solutions

- Estate and Trust Services

- Charitable Giving Strategies

Our Investing Philosophy

I believe that a skilled portfolio manager is not afraid to do something different. By working with people who believe what I believe, together, we step across the invisible line, we challenge conventional and flawed thinking, and we achieve concrete results.

Our competitive advantage in management of equity securities results from the disciplined application of our equity selection philosophy which is based on adopting a business owner mentality while adhering to a "Margin of Safety" principle. This simple concept has become the cornerstone of our investment philosophy and this methodology is applied consistently regardless of short-term market events.

MEET YOUR ADVISOR

Our team will work together, collaborating with our dedicated team of Raymond James Ltd. specialists, to diligently apply decades of cumulative industry knowledge and experience to analyze, research and strategize on your behalf.

Charles Wilton

Simplifying the complexities of wealth. Preserving capital and managing risk are two important objectives for investors, and in today’s global economy, they can be more challenging than ever. Over the years, I’ve had the privilege of helping clients manage the complexities of their wealth through a careful consideration of investment options and a strategic combination of traditional investment solutions and more sophisticated investment alternatives.

Don’t change your process because the market is going against you.

At times, you will underperform based on a value process.

A good portfolio manager has a process and stays true to that process, without adjusting and altering according to market fluctuations.

Without a proper process in place, investors change their approach according to how the market is performing in relation to their investments. If a process is constantly under scrutiny to the point where reactive changes are continually made, well, this isn’t an effective process.