An Uncomfortable Dance . . . . . When Will the Music Stop!

I hope this summer update finds you enjoying or planning for summer fun and memories!

This year, summer was late to arrive but hopefully it decides to stay for a long fall.

In the last few months, I have been actively gathering and reviewing information from past recessions – focusing on the more inflationary times in the 60s, 80s to 90s, and I am growing concerned. There is no way to sugar-coat some of the concerns, so I am going to dig right in.

Interest rates

Interest rates in the past 15 years have been reflective of the 2008-2009 financial crisis. The monetary response was to rectify a very serious financial capital deficiency that arose from rate stressor in the mortgage industry. The last meaningful time rates rose quickly, oil prices were significantly contributing to inflation pressures. The actual fundamentals of weakness started to show cracks in 2007. The full-on crisis presented in 2008-2009.

Current interest rates are restrictive in current terms but not restrictive in historical terms. In recent research, I went back on the Bank of Canada inflation numbers for as long as the records have been kept and the type of inflation that is “sticky inflation” is very similar to the inflationary pressures that were part of the challenges of the 80s.

Wages and interest costs are key in this cycle – we have had too many strikes to recount, all resulting in wage compensation that will continue to trickle in as the contracts are typically 3–5 year contracts. I don’t believe we have seen the last of strike/wage demands.

Small business has incurred a significant rise in bankruptcies in recent months, I suspect there will be more. Wage pressures continue to be felt. June 2nd, minimum wage increased to $17.40 per hour. There are still “stressors” in the business economy that ultimately flow through to the consumer.

A key scenario that concerns me is the expectations on the reset interest rates. If this current cycle equates to a 1-1.5% reduction as per the current forecast from the “street economist” for the Bank of Canada to bringing rates to the 4.00% range. If inflation continues and doesn’t abate due to the “new normal” on rates, there could be a repeat of the fundamentals that pushed the inflation equation in the 80’s to then take us to higher rates for longer. This could have huge consequences.

One of the key contributors to the inflation equation is INTEREST RATES!

Currencies

A secondary challenge for Canadians is the other impact on the Canadian dollar. At present, with the Bank of Canada being the first central bank to reduce rates ahead of the U.S., the move has resulted in weakness in the Canadian dollar. The final result is imports (especially fresh produce and food) will cost more, resulting in “inflationary” pressures. Most businesses will order goods six to nine months ahead of the season – the costs of shipping and goods in US dollars will have increased since the original ordering and hence the business has no choice but to flow at least some of the costs through to the consumer.

Government Debt Globally

The amount of government debt globally is becoming very concerning to me. In my 35 years, I have not seen such a disregard for fiscal responsibility. It does not matter which political party is in power, all have been spending like drunken sailors in my eyes.

The very real consequences of this are the “global investor” and participation in government bond auctions – if the “global investor” doesn’t like the direction a country is heading, they don’t show up at the auction and the country has to increase the rate of return to attract buyers. Not to mention, if government debt was growing at 2.5% rate environment and now the coffers have to fund maturing debt at 5%, that interest servicing would have literally doubled in the last 18 months. This is an incredible drag on cash flow for all governments. Any wonder we have had change in the capital gains tax; effectively, the cost of funding our debt is taking more and more tax dollars to maintain.

If there was EVER an impetus to bring back Canada Savings bonds, this would be it. I would be happy to buy Canada Savings bonds and have our country self-fund and try to bring back some of the “financial leverage” into the friendly hands of Canadians. But I digress; as most leadership is currently not the sharpest tools in the toolbox, we are not getting visionary thinking at all, back to the key writing.

Employment

Current employment strength is starting to slow in the private sector; this is important! Employment numbers tend to lead the slow-down, this is starting to show in numbers in Canada and the U.S. As I write this commentary, U.S. employment numbers came out this morning and the largest “job creator” was the US government, not ideal.

In 2007, employment peaked and, in reflection, the numbers continued to be revised downward each month, prior to the tipping point that culminated in the Great Financial Crisis. This concerns me, as I have watched the revisions since January 2024. Slight revision but revisions none the less.

Geo-Political Concerns

Where do I begin… global discord with leadership is an understatement. There continues to be a leaning to the far right in many global areas. What does this more protectionist position mean for global trade and economics. There is significant change afoot and I have no idea where the dust will settle. As I write this, U.K. elections have firmly ousted the conservative party that had been in power for 16 years, and now France, completes their election and thankfully the far right, did not succeed with a sweep but a fragmented government will be challenged to deal with issues with such fragmentation of power.

Is globalization dead as we have known it? I do believe a long shift is in progress with all the tensions with China reliance. New alliances continue to form as governments move towards a more protectionist stand.

Market Dynamics

The market dynamics have been dominated by AI. I don’t believe I need to delve into that too much as it is well known from the daily news that it’s a handful of tech companies that have the markets hitting new highs. This is not deemed a balance market in my eyes.

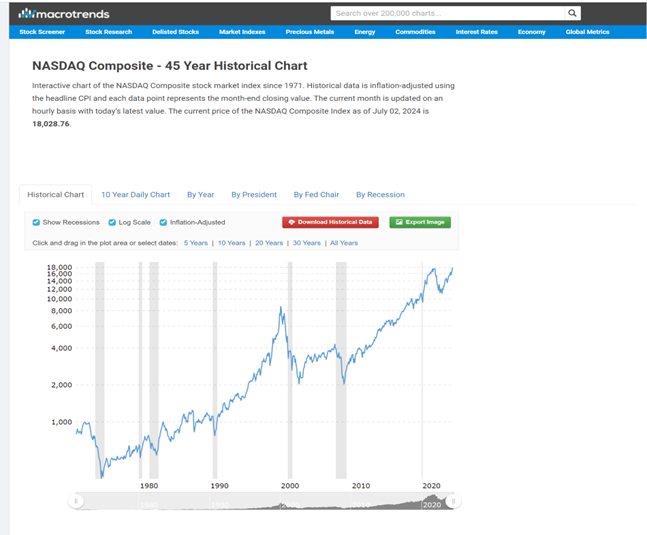

I was 15 years into my career when the tech bubble burst in 2000 and, to me, it is looking very familiar. Valuation for AI has certainly skyrocketed and it’s concerning. It has become a one-focus race and distorted valuation is primed for perfection. In the NASDAQ decline of 2000, stocks retreated nearly 70% from their highs. Memories have faded as to what “revaluation” could look like.

I also would like to remind clients that the “stock market” is a reflection of EXPECTATIONS, not a certainty of value. We certainly watched that play out in the cannabis stocks – they are literally cents on the dollar today. The industry ran to over-produce said product and ultimately, the market saw that there was over capacity. Hence it drove competition and so, all those funds raised that were a “no-brainer” to make money did not materialize in the manner that pundits were proclaiming.

Do I think this could happen in AI? ABSOLUTELY, revaluation the more players join the game. This concerns me greatly. In my career, I have seen it too many times and it doesn’t matter the product, high expectations and over-supply will drive competition. That is what an open market is supposed to achieve; so, it is natural process. See chart below. Asset evaporation, like in 2000, typically takes years to come back.

Chart source: Macrotrends July 6, 2024

So, what is my recommendation, at this time? DEFENSE is the best offense!

As I proceed with the summer reviews, I will be discussing non-performing investments and reviewing in the FULL CONTEXT of performance of the portfolios. At these times when there is a dislocation in performance in the market, it is key to see the portfolio as a “whole performance” and protect the downside or the recent appreciation and profits as a whole.

Hence, in our conversations, I will look to “lighten some strong positions” and offset those capital gains with any potential capital loss from non-performing investments, as this will ensure the “rebalancing” is completed in the most tax-efficient manner possible.

That all being said, it is about managing the risk and volatility going forward.

I may be early in protecting client portfolios from a pullback or recession. These events never transpire in an orderly fashion, my experience gives me the confidence to remove some risk while preparing for what then will be a future opportunity.

It is not my recommendation to be “fully out of the equity markets” but to be prudent in protecting profits and BALANCE of risk. This is the focus and bottom line; I will be discussing with each client their personal scenario and sense of risk and volatility.

In the meantime, short-term money market can provide 4.35% to be patient, this compares with a dividend yield (albeit not as tax efficient) but is certainly compelling to park funds for a short term.

I look forward to discussing your perspective and position in coming weeks. I want to have a conversation with every client this summer, in preparation that is specific to you. Where you are in your “age and stage” will have some bearing on recommendations.

This email was to “start the dialogue” with you all and set the stage.

We will be reaching out to schedule calls with all clients. As always, you are welcome to call the new office at 250.954.2474 to schedule as well.

Look forward to connecting in coming weeks.

Best regards,

Bonnie Cyre