Building and preserving wealth at every life stage

Managing wealth with an eye toward the future demands vigilance and skill in today’s global economy. With Dale Gagnon of Raymond James Ltd., you are provided a depth of ability and resources to match your needs and to help you make the most of each investment opportunity. We offer an array of personalized services, total wealth solutions and expert advice that can help make a positive difference in the pursuit of your financial goals.

Whether you’re currently in retirement, preparing for the next chapter in your life, or just starting out - our team will build a financial plan that addresses your individual needs and financial goals.

🖂 Start the Conversation today

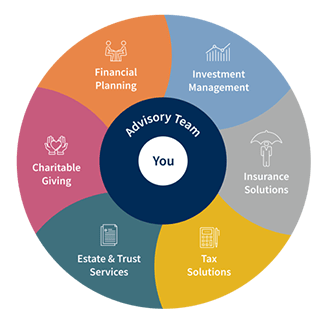

Total Wealth Solutions

We believe that professional advice, on-going education, and wealth planning are key to success. Our total wealth solutions approach looks at your entire life and all its moving pieces to incorporate;

• Financial Planning

• Investment Management

• Insurance Solutions

• Tax Solutions

• Estate and Trust Services

• Charitable Giving Strategies

A Partnership Focused On You

Our goal is to help you exceed your goals. We aim to build a deep lifelong relationship with you to reduce the stress in your relationships. Supported by our team of specialists, we partner with you, engage in a deep discovery process, and develop a personalized plan for the long term. We connect you with key specialists who are dedicated to help you use your wealth to create the life you envision.

MEET YOUR ADVISOR

Raymond James Ltd.

Dale C. Gagnon, FMA, CIM®, FCSI®

Leveraging almost three decades of investment management experience, I provide trusted advice and customized wealth solutions to high net worth families in the Ottawa-Gatineau region, helping to preserve their capital and build long-lasting, value-added relationships – one client at a time.

My goal is to deliver greater financial freedom through strategically tailored Wealth Plans, Estate and Tax Strategies and access to some of North America’s best investment managers. I am particularly sensitive to the need for frequent and honest communication – whether it involves developing quarterly touchpoints for market updates, travelling to meet clients face-to-face in their home or office to prepare for key life events, annual reviews to discuss possible changes to the financial plan, and highly personalized written statements outlining investment performance and asset allocation.