Beware of Market Jargon

Earlier this year, I wrote an article, “Common Sense Investing – An Oxymoron?” (click here) which focuses on the belief that if investors practiced common sense every day by simply not allowing themselves, no matter how tempting it might be, to succumb to the hype of the market, they would enjoy a far better and more rewarding investment experience along the way.

One thing that always confuses investors though is the use of certain jargon by portfolio managers, investment strategists, market pundits and commentators to describe different investment styles. Examples of these are; defensive versus cyclical, growth versus value, GARP (growth at a reasonable price or deep value. The question of course is which one is better?

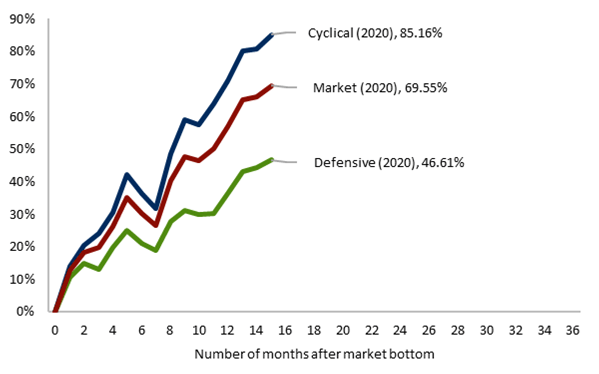

I saw a graph the other day suggesting now is the time to overweight your exposure to cyclical stocks based on the argument that in post-recession periods, they tend to outperform as the economy enters the expansion phase of its recovery. The graph illustrated what has been happening since the market bottom 15 months ago.

Performance after 2020 market low

Source: FactSet, Raymond James Ltd. (2020 recession low was on March 2020)

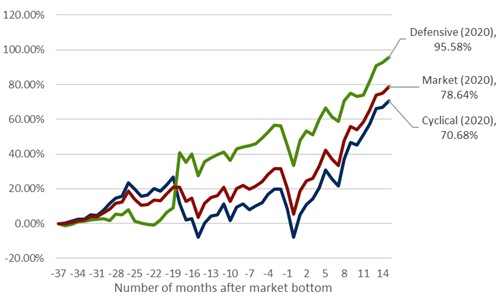

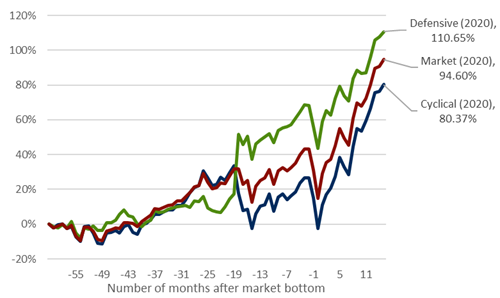

Interestingly enough though, when you look at the three and five year period before the March, 2020 low until now, defensive stocks have not only outperformed the broader market (S&P/TSX), they have outperformed cyclical stocks as well.

3+ years before/after 2020 market bottom graph:

5+ years before/after 2020 market bottom graph:

So what does this tell you? Simply stated - an investor should always think LONG TERM because trying to time the market is a mugs game otherwise. If you are a speculator or a trader then all bets are off for you in trying to predict the outcome.

David J. Angas, CEA

Senior Vice President, Financial Advisor

Family Wealth Counsel Advisor Group/Raymond James Ltd.

The views are those of the author, David Angas, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member - Canadian Investor Protection Fund.