Emotional Rollercoaster

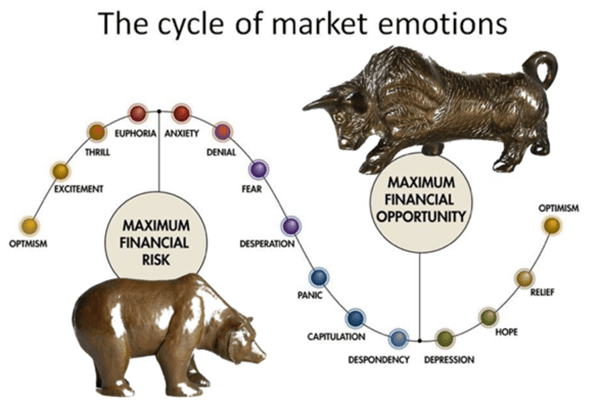

The month of September has proven to be difficult in all areas including continued conflict between Russia and Ukraine, devastating hurricanes and floods around the world and worsening financial markets – actually not only difficult but in fact out right depressing. We are being bombarded with news regarding personal tragedy and destruction across the globe and on top of that predications of market crashes. It is normal to be nervous and one can make incorrect emotional decisions that might be counteractive (see above chart). However, we do know that markets will recover in a matter of time and giving in to emotional investment decisions almost always ends in a worsened financial position.

We have moved our portfolios to be more defensive and due to the increasing interest rates, we finally have the opportunity to invest in fixed income where we can significantly increase the yield and reduce capital risk – something we could not do for the past many years. High quality dividend securities provide safe cash flow and tend to recover first when the markets start a rebound. They also mostly are in essential service business, which will always have demand and therefore revenues.

In one of our recent Family Wealth Counsel newsletters, there was an article written in the Financial Post by Tom Bradley. This article provides good reminders about investing and we would like to share a few with you that are relevant now.

You can’t predict the market … ever. Really: No matter how confident and persuasive somebody is, don’t be fooled. They have no clue where the market will be in a month or a year

Last year’s return is a good predictor … of last year’s return: “Past returns are not an indicator of future returns.” Going forward, markets will be different, as will the strategies that work best.

If it’s on your newsfeed, you’re the last to know: The market is an amazing processor of information. If it’s in the newspaper or on your phone, it’s already factored into stock prices. Remember: You’re reading September 2022 news. Mr. Market is reading March 2024.

You’ll never get lost if you don’t know where you’re going: Every dollar you invest must have a clear purpose: retirement, kids’ education and vacation home. Different goals and time frames require different portfolios and measures of success.

There’s never been more uncertainty. NOT: It feels like there is more uncertainty than usual when stocks are gyrating and the market is dropping. There’s not. The variables that drive stock prices are no more uncertain than when markets are steadily rising. The only thing that’s changed is investors’ emotions and how they process the variables.

Over the long term, our clients have not lost capital and in fact, portfolios continue to have a very positive long-term performance despite the recent correction. That is what investors must focus on with confidence that although we will most likely continue to face volatility and perhaps further financial deterioration, the markets will return to positive performance as they historically always have.

Family Wealth Counsel Advisor Group

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Family Wealth Counsel Advisory Group, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.