Turning Non-Deductible Mortgage Interest into Tax Deductible Investment Loan Interest

In an environment of high tax rates and minimal “tax breaks” for many everyday Canadians, it is to no surprise that many tax practitioners and financial advisors receive questions about how clients can pay less in taxes and write off more of their expenses to reduce their taxable income. One common question is whether mortgage interest can be used to reduce taxable income, which is not surprising given sky-high housing and mortgage interest costs.

Unlike the US, which allows mortgage interest as an itemized deduction to reduce taxable income, Canada has no such provision in its tax legislation for principal residences. This has led to tax advisors and financial advisors alike to think outside of the box on how to transform non-deductible mortgage interest into a tax-deductible expense.

At first glance, swapping non-deductible interest for deductible interest would seem like a no-brainer for home owners looking to reduce after-tax expenses. However, as this article will describe, there are many important considerations one must consider to ensure they stay compliant with tax rules while balancing the risks of using leverage to invest.

Under ideal circumstances, this strategy, also known as the Smith Manoeuvre, could accelerate paying off the principal residence mortgage, helping people achieve their financial goals sooner. However, high interest rates and risk of market downturns could also lead to undesirable outcomes. One should also consider whether other tax saving strategies, such as maximizing TFSA and RRSP contributions, may complement this manoeuvre or perhaps yield even beneficial results.

When is interest tax deductible?

The rules of interest deductibility are complex, but in essence, paragraph 20(1)(c) of the Income Tax Account requires that for interest to be deductible, the interest must be pursuant to a legal obligation to pay interest on borrowed money used for the purposes of earning income from business or property.

These tests boil down to the borrow test, purpose test, income test and use test. All these tests must be met for income to be deductible for tax purposes.1

From this high level description, it is clear why a regular mortgage on a principal residence does not meet the criteria of interest deductibility – the borrowed money is not used to earn income from business or property.

Examples of property income include interest, dividends, rents and royalties, but importantly do not include capital gains. Therefore, when one borrows money to invest, it is important to consider the interest would not be deductible under 20(1)(c) if it is borrowed to earn capital gains. As discussed later in the article, this would impact the type of investments one would make using this strategy.

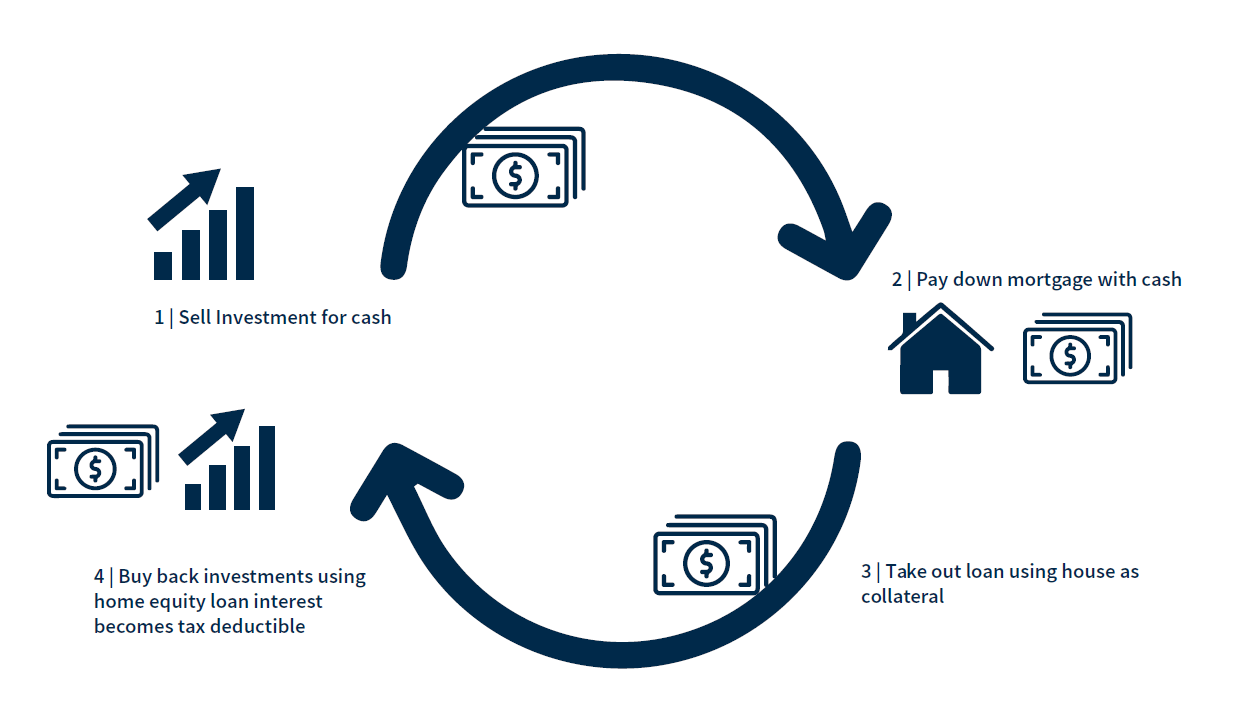

Creating Deductible Mortgage Interest

In order to meet the tests discussed above, one would need to take out a loan to invest in assets that generate property income. Generally, when one has equity in their home, they would take out a home equity loan of credit, or a HELOC, which allows individuals to borrow up to a certain percentage of the value of their home.

Under this technique, the loan funds from the HELOC would be invested in a non-registered investment account, which must generate taxable income from dividends and/or interest. When the borrower makes their mortgage payment, the amount of mortgage principal would be borrowed again under the HELOC and reinvested to earn property income. This in turn, converts non-deductible mortgage interest into deductible invest loan interest.

What is crucial to consider however, is that swapping one form of debt that doesn’t generate tax deductible interest to a form of debt that does, in itself may not be beneficial.

Consider the following – HELOC rates are generally higher than regular mortgages on a principal residence. For a more accurate comparison, one would need to look at the real rate of return, which would be the interest rate after one’s marginal personal tax rate. If this marginal tax rate is not high enough, due to a lower level of taxable income, this technique may not yield beneficial results.

Another consideration is that using leverage to invest can be risky as well. As explained, the HELOC must invest in assets generating income, but in the event of a market downturn, the underlying assets may decrease in value, while the interest on the debt still must be paid at a premium interest rate.

In addition, when selling investments to pay down the principal residence mortgage, taxpayers may incur additional tax on capital gains, the timing of which may not be ideal.

Paying Down Mortgage

When using this technique, one pays down the mortgage on their principal residence while simultaneously increasing their HELOC and investment portfolio. To accelerate the pay-off of their mortgage and to yield the benefits of this technique, the tax refund from the interest deduction is applied toward the principal of the mortgage, shaving months/years off the life of the mortgage and further reducing interest payments.

Example of Smith Manoeuvre in Action

Using these example figures, one would increase the HELOC balance annually by the principal payments of the mortgage, use the HELOC to invest, and use the tax refund from the deductible HELOC interest as additional repayments toward the mortgage. By utilizing the Smith Manoeuvre, one would increase tax deductible interest through an increasing HELOC balance, which funds the investment portfolio, year over year.

Example Figures

| Primary Mortgage Balance - Year 1 | 400,000 |

| HELOC Balance – Year 1 | 200,000 |

| Mortgage Amortization - Years | 25 |

| Principal Residence Mortgage - Interest Rate | 6% |

| HELOC - Interest Rate | 7.5% |

| Investment Rate of Return | 5.0% |

| Marginal Tax Rate | 46% |

| Annual Regular Mortgage Payments | 38,000 |

With using the Smith Manoeuvre with these illustrative example input figures, the mortgage would be fully paid off in the beginning of year 13, whereas by not utilizing this Manoeuvre, at the end of year 12, there would still be a significant mortgage balance of approximately $160,000.

This model does not consider capital gains taxation from selling the non-registered investments to pay off the HELOC, which is assumed to occur when the mortgage balance reaches zero.

In this illustrative example, over the course of 15 years, net after-tax cash flow by utilizing this manoeuvre is approximately $50,000 less than had the technique not been employed. However, it is important to note that there is a larger annual cash outlay by using technique in the years that there is still a mortgage balance. This is explained by the fact that interest rates on the HELOC is illustrated to be higher than the rate of return on the unregistered investments.

Therefore, what is important to understand about this technique is that it is generally a long-term financial strategy. The Smith Manoeuvre may only result in cash flow savings after the mortgage is paid off. This technique may not be suitable for individuals looking to reduce their annual housing costs in the earlier stages of their mortgage amortization, considering the costly leverage.

There are a number of assumptions in the example above which could result in the Smith Manoeuvre yielding less desirable, and even negative results, including:

- This model assumes the individual is in a high tax bracket of 46%. If a taxpayer is in a low tax bracket, the savings from the investment loan interest deduction may not offset the premium in the interest rate they pay in the HELOC versus their principal residence mortgage.

- This model assumes that interest rates were stagnant over 15 years, for illustrative purposes, however as we have seen in recent years, interest rates are highly variable and fluctuations in interest rates could result in less desirable outcomes.

- This model does not account for fluctuations in the investment portfolio, it assumes that the investment portfolio capital is equal to the HELOC balance. This is under the assumption that investments whose returns are in the form of dividends and interest may not fluctuate in their share price (stocks) or face value (bonds) as extensively as stocks whose value is derived from capital appreciation. However, there is always risk when using leverage to invest as the underlying investment may decrease in value, whereas the debt has a fixed amount.

Risk Tolerance

As discussed earlier, borrowing to invest may seem like a reasonable strategy when considering past market performance. However, it is important to remember that historical market performance does not guarantee future performance, and one must consider how much volatility they can endure when making investing decisions. Watching the value of investments fall when the investments are leveraged with high interest debt can be stressful and get in the way of other financial goals.

Additional Consideration – Income from Investment Loan

Apart from risks of borrowing to invest, it is also important to consider some additional risks with this technique in terms of deductibility.

As discussed in the Income Tax Folio S3-F6-C1 Interest Deductibility paragraphs 1.27 and 1.69:

for interest be payable on borrowed money used for the purpose of earning income from a business or property. The interpretation of the term income was addressed in the court case, Ludco as follows:

... [I]t is clear that "income" in s. 20(1)(c)(i) refers to income generally, that is, an amount that would come into income for taxation purposes, not just net income.

The court also said:

The plain meaning of s. 20(1)(c)(i) does not support an interpretation of "income" as the equivalent of "profit" or "net income".... Therefore, absent a sham or window dressing or similar vitiating circumstances, courts should not be concerned with the sufficiency of the income expected or received.

…where an investment carries a stated interest or dividend rate, the income-earning test will be met "absent a sham or window dressing or similar vitiating circumstances". Further, given the meaning of the term income…and assuming all of the other tests are met, interest will neither be denied in full nor restricted to the amount of income from the investment where the income does not exceed the interest expense.

Where an investment does not carry a stated interest or dividend rate, such as some common shares, it is necessary to consider whether the purpose test is met. Generally, the CRA considers interest costs in respect of funds borrowed to purchase common shares to be deductible on the basis that at the time the shares are acquired there is a reasonable expectation that the common shareholder will receive dividends.

Given that interest rates on the HELOCs may likely exceed the rate of return on dividend or interest-bearing investments, it is helpful to know that the court’s current interpretation of the Canadian taxation rules should not limit the interest deduction, just because there is no net profit when subtracting the interest expense from the dividend or interest income .

That said, careful consideration should be made with one’s tax accountant regarding whether interest is deductible on a personal tax return, as all factors must be taken into account to ensure that the requirements under 20(1)(c) of the Income Tax Act are met.

Note that for Quebec provincial tax purposes, the deduction of investment expenses (including interest expenses) is limited to the amount of investment income a taxpayer earned in the year. Any investment expense that’s not deductible in a year, as a result of this limitation, can be carried back to the three preceding years or carried forward to any subsequent year.

Closing Thoughts

The Smith Manoeuvre is a technique that Canadians who have equity in their homes could consider in order to potentially pay off their mortgages faster. Using debt to invest can also involve considerable risk, and the adoption of such financial manoeuvres should be discussed with trusted professionals.

If you have any questions about this technique and how it could impact you, our team of financial and tax advisors at Raymond James are available to help.

This has been prepared by the Total Wealth Solutions Group of Raymond James Ltd., (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities nor is it meant to replace legal, accounting, taxation or other professional advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The information is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. This is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., Member - Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a Member - Canadian Investor Protection Fund.