Trump 2.0 Tariffs: Impact And Market Reactions

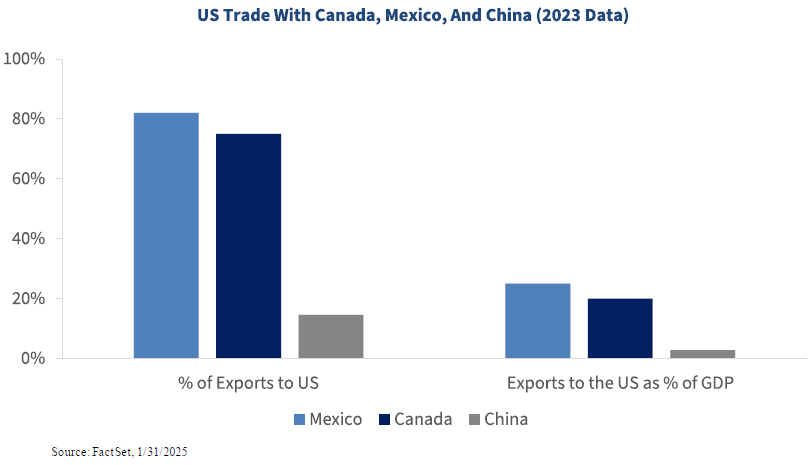

President Trump has proposed sweeping tariffs for America’s top three trading partners—Mexico, Canada, and China. These countries account for $1.4 trillion of imports into the US, equating to 45% of all US imports. The US is placing a 25% tariff on all imports from Canada, except energy commodities at 10%. For imports from Mexico, the rate will be 25%, and for imports from China, it will be 10%. These measures were set to go into place on February 4th—however, the tariff on Mexico has been delayed by one month as Mexico agreed to reinforce the border against drug trafficking with 10,000 National Guard members. Uncertainty remains on the tariffs on Canada and China. President Trump is expected to speak with Canada’s Prime Minister Trudeau today at 3 PM.

President Trump invoked the International Economic Emergency Powers Act (IEEPA), a 1977 federal statute granting the president extensive powers to address national emergencies, to enact the tariffs. While the IEEPA has not been used to enact tariffs before. President Trump sees this within his legal authority to address a national emergency, fulfilling his campaign promises to stop illegal immigration and the flow of narcotics across borders.

The rapid escalation in tensions signals the growing prospects of a trade war. While President Trump opened up dialogue with leaders in Canada and Mexico today, retaliatory tariffs announced by these countries will likely strain relations. A wider trade war cannot be ruled out, as President Trump has also threatened new, potentially “substantial” tariffs on the European Union, citing our persistent trade deficit with them. The newly announced tariffs are much broader in scope than those enacted in 2018, potentially being several times larger.

What Are The Uncertainties That We Need To Be Aware Of?

This situation is just beginning, so we must acknowledge that there are more questions than answers at this point. Multiple sources of uncertainty will keep investors guessing as the situation unfolds.

- How long will the tariffs last? While the tariffs on Mexico were delayed by one month, it is unclear if the China and Canada tariffs will go into place as scheduled (on February 4th.) However, if they do go into place, it is anyone’s guess how long they will last. The longer they remain in place, the more economic impact there will be. On the other hand, companies will gradually adapt their supply chains which could lessen the impact.

- How will the other side(s) respond? It is safe to assume that all three targeted countries will respond with countermeasures, including tariffs of their own. Canada was the first to announce tariffs on up to C$155 billion (US$107 billion) of US products. Mexico and China have yet to detail their responses. The White House orders include a provision for escalating US tariffs if the other side(s) respond in kind.

- Is this even legal? The legal authority for the tariffs comes from the International Economic Emergency Powers Act of 1977. However, this law has never been used so broadly against America’s largest trading partners. It is unclear whether cross-border drug trafficking qualifies as an "economic emergency” justifying this law. For US federal courts to weigh in, a US company affected by the tariffs would typically need to bring a case. As of now, no corporate lawsuits have been filed, but the risk of litigation will rise over time.

- How will the domestic political context evolve? This is President Trump’s first major decision in his second term, and the outcome will influence his domestic political standing. President Trump likes to exude strength. As a result. Trump tends to view concessions as a sign of weakness, so he will likely follow the same playbook here. The timing of the tariff move will impact other near-term domestic issues, such as lifting the debt ceiling (a likely priority in the next few months) and tax reform (likely later this year).

- Will Trump have constructive dialogue with foreign leaders? The White House has signaled that the tariffs are intended to spur negotiations. Trump and Canadian Prime Minister Justin Trudeau are having a conversation today. Trudeau is stepping down soon, and his successor will face a general election between now and October. Given the harsh public reaction in Canada to Trump’s tariffs, Canadian leaders are unlikely to compromise during the election campaign. The relationship between Trump and China’s Xi Jinping has a longer history, with ups and downs. Xi does not need to worry about a domestic electorate, but it remains to be seen how open he will be to compromise. However, on the flipside in Mexico, Claudia Sheinbaum’s efforts to send more troops to the border (e.g., concession to President Trump), helped to delay the potential tariffs by one month. This highlights that this situation remains fluid, and that President Trump will continue to use tariffs as a bargaining chip.

Our Initial Thoughts On Our Economic And Market Views

Volatility | We have previously identified overoptimism among investors as the biggest market risk, with many overlooking potential threats, particularly those originating from Washington. Specifically, we highlighted the market's underestimation of the potential impact of tariffs. Investors perceived these tariffs as a mere ‘negotiation tactic' rather than considering the significant economic ramifications of their 'implementation'. As the market and corporations begin to digest these impacts, we anticipate that volatility will remain elevated over the coming months. This period of adjustment will be crucial as the true effects and magnitude of these policies become clearer, influencing our economic and asset class outlook.

Economy | The economic impact of tariffs will depend on their extent, duration, and potential escalation into a trade war. If the proposed tariffs are implemented for the entire year, they could generate up to $250 billion in revenues and cost the average household around $1.5k, reducing GDP by 1.1 percentage points in 2025. However, considering demand elasticity and substitution, our forecast is that the impact might be more muted, with $150 billion in revenues, costing less than $1,000 per household, and reducing GDP growth by 0.5 percentage points.

Tariffs will affect prices for a wide range of products, especially autos, fuel, food, and consumer electronics. The US imports heavily from its neighbors, with machinery and automotive products being significant categories. The integrated supply chain in North America makes it challenging to disentangle cross-border relationships. Mexico and Canada are key partners, with a substantial portion of their exports destined for the US. Tariffs on Canadian and Mexican energy commodities and food products will lead to higher prices, impacting various sectors, including manufacturing and agriculture.

The US imports many raw materials and production inputs from Canada, which will be subject to tariffs, raising producer prices. Tariffs on Chinese imports, although lower than initially proposed, will still result in higher prices for electronics and other goods. The Federal Reserve is likely to remain data-dependent and hold rates until the situation stabilizes. While tariffs negatively affect all economies involved, the US’s diversified economy and strong dollar may help cushion some impacts. Canada and Mexico might face significant challenges sooner, potentially leading them to negotiate earlier.

Fixed Income | This weekend’s tariff announcements have triggered a flight to quality in the bond market, with Treasuries benefiting as riskier assets come under pressure. Further weakness in equities could drive Treasury yields lower and reverse the recent steepening trend.

While it is still early to determine the full impact, the initial moves in Treasury yields appear rational. The policy- sensitive 2-year Treasury yield jumped to 4.28% as the potential inflationary impact from tariffs could see the Fed remain on hold longer than expected. Market expectations for the first Fed rate cut in 2025 have been pushed back to July, with fewer than two rate cuts now priced in by year-end. However, longer-maturity yields have modestly declined to ~4.5% as tariffs are likely to lead to tighter financial conditions (e.g., a stronger US dollar, softer equity prices, wider credit spreads) and weaker growth.

With the news still unfolding, we are reluctant to change our year-end views on the 10-year Treasury. We expected it to remain rangebound between 4% and 5%, ending the year at 4.5%. This range still seems plausible. However, we will closely watch the duration of the tariffs and their impact on consumers, as this will significantly affect growth and inflation dynamics. The Fed’s reaction will also be key. In 2018, Fed officials looked through the inflationary impact of tariffs, and we sense they will do the same this time, as they still believe their policy stance is “meaningfully restrictive." There are ten Fed speakers scheduled this week, so it will be interesting to see how aligned they are with this view now that tariffs have been enacted.

While assessing the impacts is challenging due to many unknowns, the recent tariff announcement should keep volatility elevated, particularly given the current macro backdrop, debt ceiling negotiations, and the upcoming quarterly refunding announcement. From a technical perspective, we are watching the crucial 4.5% threshold. A break below this level on the 10yr could see yields fall back towards 4.25%, closer to the 200-day moving average.

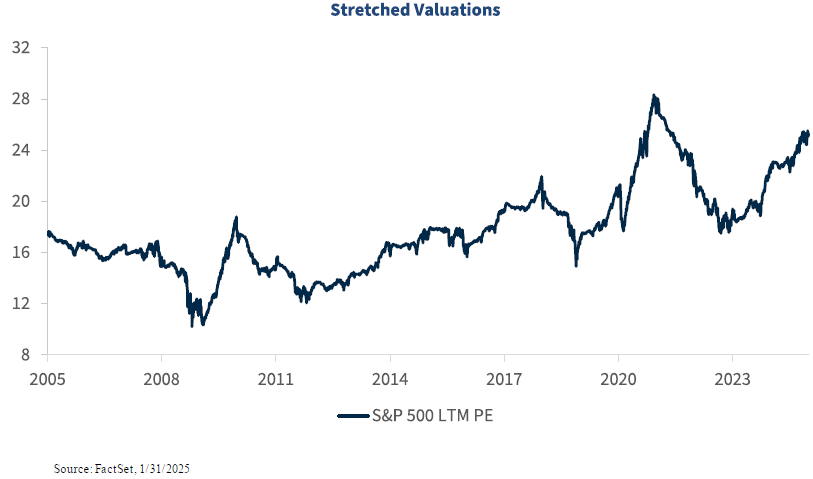

Equity Market | While we held a positive, yet more cautious view than the consensus on the equity market coming into the year (S&P 500 target 6,375), we expressed caution due to stretched valuations and a record percentage of investors expecting stock prices to rise. These factors left limited room for error, and the recent uncertainty from tariffs highlights how volatility will likely remain elevated over the next 12 months.

Fortunately, corporate fundamentals remain solid, as evidenced by the 4Q24 earnings season, and overall revenue exposure to tariffs is fairly limited. The S&P 500 receives only 1%, 1%, and 7% of total revenues from Mexico, Canada, and China, respectively. No sector derives more than 5% of revenues from Mexico and Canada, though consumer staples, energy, and materials are the most exposed.

The biggest impact could be on input costs and earnings. With valuations already stretched, earnings growth needs to drive the market higher over the next 12 months. Consensus estimates S&P 500 earnings of $275 in 2025, with half derived from margin expansion. If businesses cannot pass tariff costs onto consumers, it could pressure earnings through weaker margins. We had a slightly below-consensus S&P 500 earnings estimate of $270, factoring in moderate tariff impacts, and feel comfortable with this forecast unless tariffs escalate further.

Volatility is a natural part of the market. Historically, the S&P 500 experiences 3-4 pullbacks of 5% or more annually. With only two pullbacks in 2024, an uptick in volatility would not be unusual. Despite tariffs, we expect economic and corporate fundamentals to remain solid, and we remain confident in our year-end target of 6,375— though the path may not be a straight line.

Currencies | The threat of tariffs has driven the US dollar higher, with the USD up nearly 6% since President Trump won the election. While many factors influence exchange rates, tariffs can be a meaningful driver of the dollar’s direction. The appreciation in the USD attributed to tariffs is three-fold: altered trade flows, inflation, and investor sentiment.

First, President Trump is concerned about the substantial trade deficits the US has with major trading partners and sees tariffs as a solution to correct these imbalances. Higher tariffs should reduce the deficit by making imports more expensive. An improving trade balance should, in theory, lead to less demand for foreign currency to cover trade obligations.

Second, tariffs are inherently inflationary. To combat this, central banks often raise interest rates to counter the inflationary impulse. Higher relative interest rates should strengthen the exchange rate.

Finally, as the US dollar is the world’s reserve currency, any geopolitical uncertainty tends to strengthen the exchange rate as investors seek stability. This is why the US dollar is viewed as a safe-haven currency—it often appreciates during periods of global economic stress or uncertainty.

With the Dollar already appreciating substantially since the election and talk of tariffs, further appreciation could be limited unless the trade war escalates. As an example, the euro is trading towards the lower end of our forecasted range of 1.00 to 1.10 as it sits around 1.03 today.

Oil | Oil is fundamentally a global market, so global supply and demand dynamics are what ultimately matter for oil prices. Trade wars are a headwind for the global economy and, consequently, for oil demand. The longer this situation persists, the more downside pressure there will be on oil prices. Our year-end forecast for West Texas Intermediate (WTI) crude remains $65 per barrel.

In the short term, the oil market will focus on how US refining companies may change their crude sourcing tactics in response to the tariffs. The logistics can be complex, with significant geographic variability. Therefore, the benchmark oil prices we see, such as WTI, may not fully reflect how prices at the pump will evolve in different parts of the country.

Bottom Line—No Changes To Our Forecasts As Of Now

As we noted coming into the new year, the market was priced to perfection—with elevated valuations and overly optimistic investor sentiment, making it vulnerable to any disappointing news on the economic, earnings, or policy front. The swift and sweeping actions taken by the new administration over the weekend highlight that volatility will remain elevated, particularly in the near term.

Given the fluid situation, it is too early to change our assessments on the economy and different asset classes. However, we remain alert to the potential fallout on growth, inflation, earnings, and the interest rate outlook from a wider or extended trade war if that is where we are heading.

During periods of heightened uncertainty, it is important for investors to maintain perspective and realize that volatility is part of the market’s fabric. Investors should stay focused on their long-term objectives and avoid making decisions based on every twist and turn in the market.