Market Musings August 2024

Welcome to summer. We trust this missive finds you well and enjoying some nice weather.

We are pleased to see that many publicly traded companies posted strong results this quarter, although, for some sectors, the investor reaction has been very mixed. In some cases, significant advances and investments in artificial intelligence are starting to pay off. These technological innovations continue to transform industries and open up new opportunities for growth and productivity.

In terms of geopolitical news, the last few weeks have kept us on our toes: the tough debate between Joe Biden and Donald Trump on June 27, the assassination attempt on Trump on July 13, the global computer outage on July 20 grounding planes, followed by Joe Biden’s withdrawal from the presidential race on July 21, making way for Kamala Harris as the Democratic candidate, all while, not to mention the escalating tensions in the Middle East, the terrible wildfires in Alberta, and so on…

For all these reasons, in the run-up to the American elections and for the economic reasons we will list below, we maintain our cautious approach to the markets. Stock market indices, which continued to rise in June and until mid-July, have been suffering a headwind ever since. No need to push on the panic button; stock market corrections being frequent and normal, decreases of 10% to 15% between a high and a low for the American stock exchange occur on average every 1.9 years since 1950, according to a study by Yardeni Research and decreases of 5% occur several times a year and in 94% of calendar years. Fears of global recession seem to be behind this correction as well as the increase in key rates announced in Japan, according to Monday's Wall Street Journal. Several institutional investors borrow in Japanese Yen for their low interest rates and the low risk of an increase in the currency value, according to them, and then invest in the American market (this strategy is called the "Yen Carry Trade"). With the Yen appreciating and Japanese rates rising, investors using this strategy are liquidating their positions, including selling their corresponding American stocks. At the same time, the largest investor in Apple, Warren Buffett, the oracle of Omaha, and his company Berkshire Hathaway, announces that he had liquidated half of his position in Apple.

- The importance of the consumer cannot be overrated. On average, the consumer is responsible for 65% to 70% of GDP in countries like the U.S., England, France, Germany, Canada, etc. The act of buying a quart of milk, a pair of jeans, a TV or a car. As such, it is clear that the consumer needs to be in good shape for the health of the economy. At present, the consumer appears to be showing signs of fatigue. As a sign of economic expansion (GDP), the consumer piece must be in constant expansion. Personal spending in both Canada and the U.S. have slowed of late. How much your debt service is costing you in these higher interest rate environments will impact how much you have to spend.

- June employment report was on the soft side, with downward revisions to payroll gains from prior months, a drop in temporary employment and only modest gains in wages. This wouldn’t be particularly notable were it not for the fact that the unemployment rate has now risen steadily over the past 14 months from a 54-year low of 3.4% set in April of last year. This has historical significance as a rise in the unemployment rate from its cyclical low has been a warning sign of imminent recession.

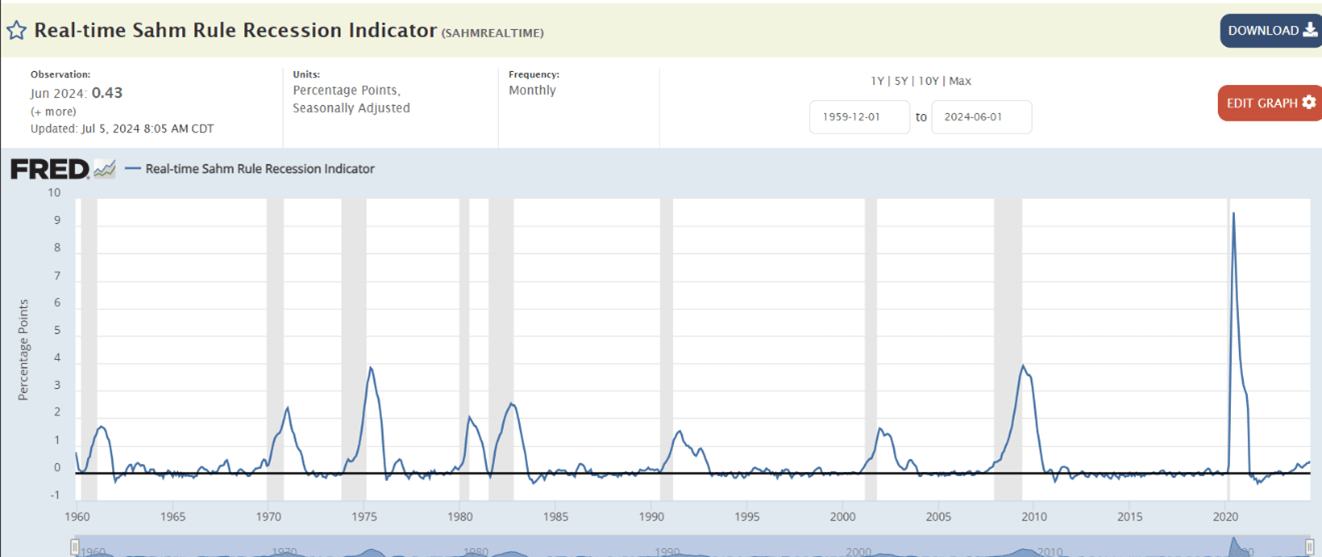

- The Sahm Rule (named for Claudia Sahm, previously of the Federal Reserve Board): The Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3)rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months. The Sahm rule would have been triggered in all 12 of the recessions seen in the United States since 1947, albeit with the signal kicking in, on average, 3.5 months after the recession had started.

Moreover, there have only been two brief instances, in late 1959 and mid-2003, when the rule implied a recession that didn’t actually transpire. The measure is currently at 0.47.

- “Inverted yield curve” rule, defined, in this case, as 3-month Treasury bill yields being higher than 10-year Treasury bond yields, signals a recession starting within a year. However, by this measure, the yield curve has now been inverted for 20 straight months with, again, no sign of recession.

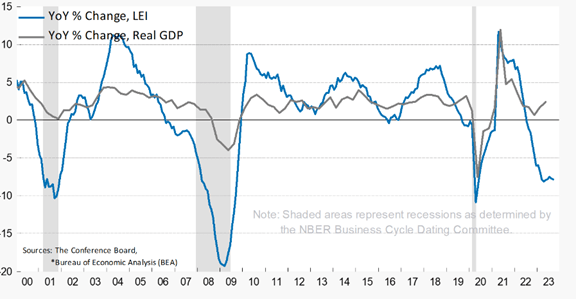

- LEI (Leading Economic Indicator): The LEI has been an accurate indicator of economic health. As per the image bellow, it is clear that the index tracks well with recessions (the grey bars), save in the current environment.

- And finally, from our technical analyst, who wrote this week:

“What is happening: The S&P 500 and Nasdaq 100 recently triggered new daily “mechanical sell” signals that are consistent with a new short-term (1-3 month) corrective phase taking hold. Weakening Price Momentum on the TSX Composite and Russell 2000 suggests they are poised to follow suit.”

All of the above does not spell doom, but the data points are significant in helping forecast where we are in the economic cycle, and explain why we are reticent to commit new capital to the equity market, outside of the conservative weights that we now have (n.b. equity exposure varies by client, as asset allocation and risk tolerance varies from one family/client to the next).

As always, we look forward to your questions and comments.

Wishing you an excellent month of August.

Erik and Guillaume, and the Patrimonia Team

Disclaimer

Erik Moisan and Guillaume Desjardins-Tessier are Portfolio Managers with Raymond James Ltd. The views are those of the authors, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member - Canadian Investor Protection Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Not intended to solicit clients currently working with a 3Macs or Raymond James Investment Advisor. If you would prefer not to be on our e-mailing list, please reply to this email with UNSUBSCRIBE in the subject line.

Raymond James (USA) Ltd

Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability. This website may provide links to other Internet sites for the convenience of users. RJLU is not responsible for the availability or content of these external sites, nor does RJLU endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy that RJLU adheres to. Investing in foreign securities involves risks, such as currency fluctuation, political risk, economic changes, and market risks.