Helping Young Adults & Young Families Manage Their Finances | Key Information for Registered Accounts (Including the New FHSA)

Finances are a personal subject, but they are not taught nearly enough in the education system to help people when they "grow up". We're expected to learn everything independently, which does not happen for the average household. Given the lack of education, it is so important to get back to the basics, especially with the current high cost of living and the impact it may be having on you and your household.

I recently read that about half of Canadians don't have a household budget or a will, and nearly six in ten Canadians don't know how much money they'll need to retire – there is certainly room for improvement here!

Simple actions can have a very positive impact on your finances and protect the ones you love. I will provide some tips and resources geared towards helping young adults and young families reach their goals and maximize their wealth.

This article covers:

- Creating a Budget

- Protecting Your Family and Your Assets

- Why You Need a Will NOW

- The Compounding Effect: Why You Need a Game Plan NOW

- Where Should I Put My Savings? Key Information for Registered Accounts

Creating a Budget

A budget can really be an eye-opener, to help you avoid overspending and track any discretionary spending habits that can be changed. Developing a budget starts with basic financial literacy, by understanding your income, expenses, and cash flow, to allocate your money more effectively.

By taking action such as limiting unnecessary expenses, reducing debt burdens and optimizing interest payments, you can free up more funds to save for your future. Don’t wait until you have money left over, after bills are paid, or until next month before setting aside money to save - paying yourself first should be a priority.

Creating a budget involves:

- Clarify your after-tax income.

- Break down spending between non-discretionary and discretionary.

- Determine what discretionary spending can be reduced or removed.

- Set up a recurring savings plan.

- Track your income and expenses using an app – most banks offer this feature.

At the end of the day, you still may find it hard to save right now. In this case, I would suggest to setup a small recurring savings plan, an amount small enough that won’t impact your finances. The hardest part is starting the habit of saving, it gets easier from there!

Protecting Your Family and Your Assets

Ask yourself one question: If something unexpected happened to me, how would this impact my family? Will the family home need to be sold to cover living expenses, vacations cut out, or some other disruption to everyday life?

If you do not have a backup plan available or are having difficulty answering these questions, insurance may be necessary to protect your loved ones, even if just for the short term. There are cheap solutions out there which can act as a “band-aid” coverage, so please reach out if you need more information, or would like to inquire about the options available to you.

Why You Need a Will NOW

It can be very costly and problematic to pass away without a will, yet over 50% of Canadians do not have wills. To avoid unnecessary financial and emotional burdens during an already challenging time, a will can ensure a tax-efficient and effective transfer of your estate to your intended beneficiaries.

If you don't have a will, make it now. Holographic, online, or see a lawyer. Just do it!

The Compounding Effect: Why You Need a Game Plan NOW

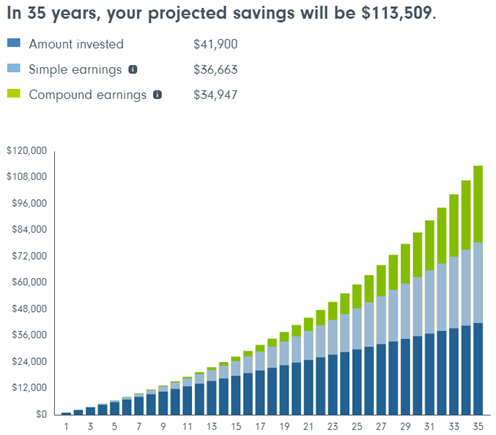

- The earlier you save for your future, the larger your nest egg will be by taking advantage of compounding.

- Each year that you delay, it becomes more costly to achieve your goals in the long run.

- The earlier you start to save, the less you need to contribute at the end.

- As shown in the graph to the right, a $100 monthly contribution for 35 years will be over $113,000 using a 5% return.

Thanks for reading!

If you enjoyed the newsletter and found it helpful, don’t forget to subscribe for future updates, and feel free to share with a friend who would benefit from this information. If you want additional information or resources on this topic, please reach out to us directly.