What is a recession, and should you worry about it?

The definition of recession is a period of temporary economic decline during which trade and industrial activity ae reduced, generally identified by a fall in GDP in two successive quarters. The key word I like my investors to focus on is temporary. Temporary decline is not something to worry about if you are a disciplined long term investor. In fact, in most cases the economy is on its way out of a recession before we can technically say we have one. Understand the irrelevance of calling or worrying about a recession. If you are accumulating great companies for the next 10 years and then you plan on living off of the revenues of these companies for another 30 years why would you worry whether or not we are entering a time of temporary economic decline. In fact, if this decline reduces prices of great companies temporarily it is a major advantage because we have a chance of buying these companies at lower prices for a temporary period of time.

Quality companies are built to easily work through a temporary economic down turn. They can become more efficient during these periods. They may very well increase market share from competitors during these periods. They may be able to borrow money at lower rates than normal during these periods. These factors and more can make them even better positioned for the future.

Conclusion: Don’t worry about a recession just make sure you own great companies all over the world and stick to your long-term plan.

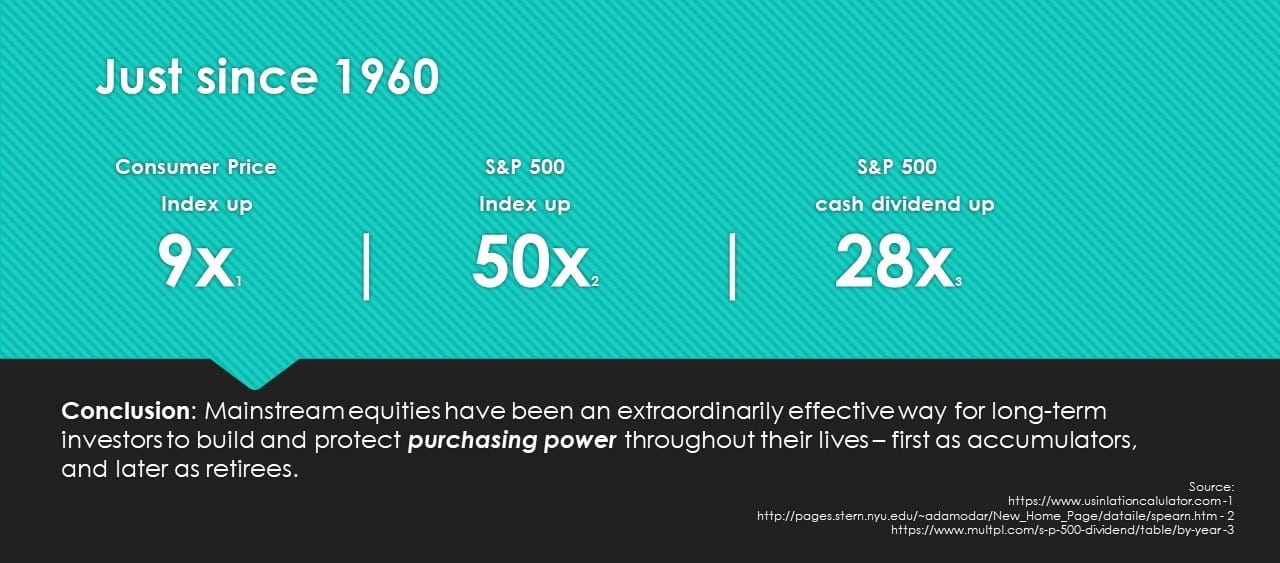

Conclusion: Broad equities have been an amazingly effective way for long-term investors to build and protect purchasing power through their lifetimes. First, as accumulators, and later as retirees. I think it’s very important to never lose sight of these facts.