Private Equity Kit

What Is Private Equity

Private equity is an investment strategy where a firm buys, acquires, or directly invests in private companies or securities, meaning they are not listed or traded on the public stock market. A private equity firm is the entity that makes these investments. Essentially, private equity involves purchasing a stake in privately owned companies based on their value and eventually selling them for a higher price than the initial investment. Additionally, the firm provides financial and strategic support to help the company grow. Although these investments can be risky and may take a long time to yield a profit, they can offer greater rewards compared to other investments. (1)

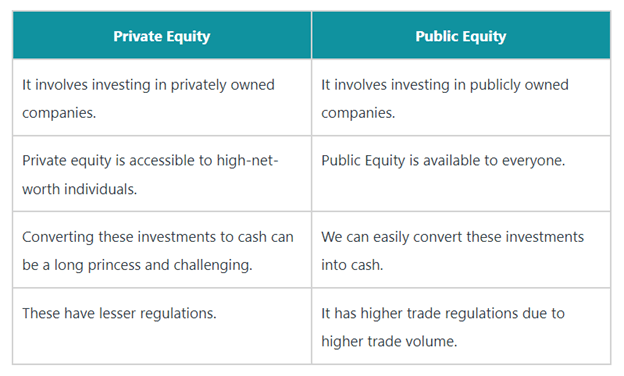

What Is the Difference Between Private Equity and Public Equity?

Fig 1

Who Invests in Private Equity

Private equity investors are primarily institutional entities, including insurance companies, university endowments, trusts, pension funds, and high-net-worth individuals. Not everyone can invest in these strategies, as they must meet accredited investor criteria. (2)

Canada Pension Plan

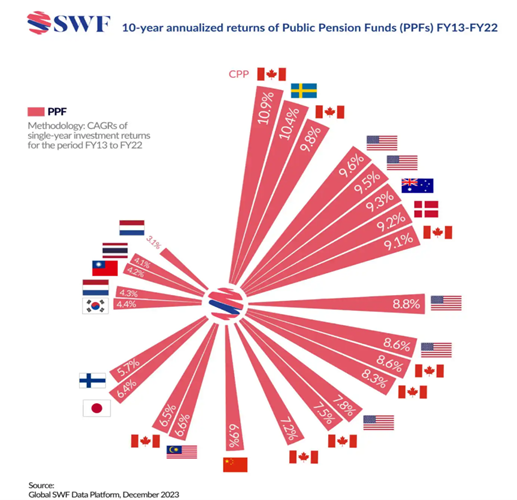

A primary example of an endowment fund using this strategy is the Canada Pension Plan fund. The investment manager for Canada’s largest pension fund has been recognized by industry experts for having among the highest returns over the past decade when compared to global peers. With a 10-year annualized rate of return of 10.9% from fiscal 2013 to 2022, CPP Investments ranked first among national pension funds. CPP Investments was lauded in the report for participating in co-investments, an investment style well-known to Canadian funds, as a way of gaining direct exposure. “CPP [Investments] is by far the most active, but others are catching up rapidly.” (3)

Fig 2

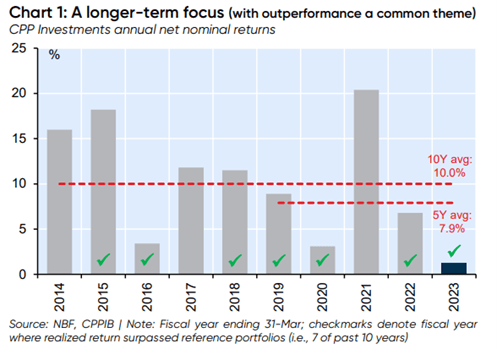

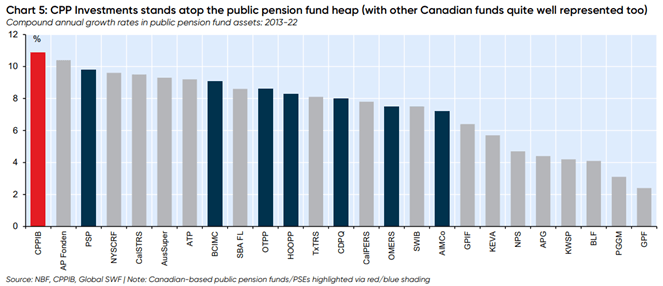

The following two charts further outline how CPP has outpaced similar funds.

Fig 3

Fig 4

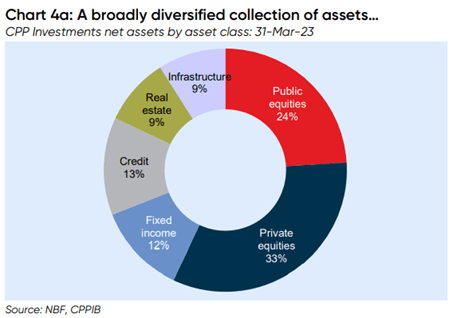

This chart illustrates the asset allocation of the CPP fund, with 33% invested in private equities.

Fig 5

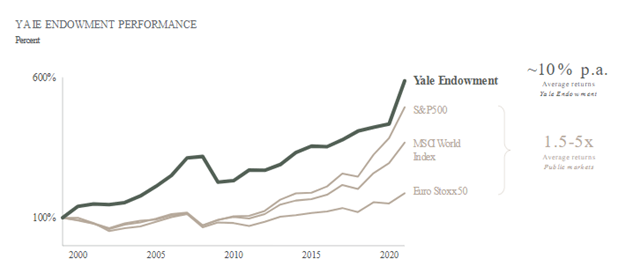

Yale Endowment Fund

Another notable example is the Yale University endowment portfolio. It is the second-largest university endowment in the country and serves as the primary source of revenue for the university’s budget. The Yale Model emphasizes broad asset diversification, allocating less to traditional U.S. equities and bonds and more to alternative investments such as private equity, venture capital, hedge funds, and real estate. Yale’s investment strategy heavily relies on alternative investments, which comprised approximately 60% of its portfolio as of 2019. These investments have shown superior return potential and diversifying power. (4.1)

Fig 6

Benefits of Private Equity

Private equity is often considered to have low correlation with public markets for several reasons:

- Valuation Methods: Private equity investments are typically valued based on periodic appraisals rather than daily market prices. This means their valuations do not fluctuate with the same frequency as public market securities (4).

- Long-Term Focus: Private equity investments usually have a long-term horizon, often spanning several years. This long-term focus can insulate them from short-term market volatility (5).

- Operational Improvements: Private equity firms often engage in active management and operational improvements of their portfolio companies. These efforts can drive value independently of broader market movements (6).

- Diverse Investment Strategies: Private equity encompasses a wide range of strategies, including buyouts, venture capital, and growth equity. These diverse strategies can lead to returns that are not closely tied to public market performance (5).

- Limited Market Exposure: Many private equity investments are in companies that are not publicly traded and may operate in niche markets. This limited exposure to public market dynamics can contribute to lower correlation (4).

Furthermore, the shrinking number of public companies highlights the need to diversify beyond them. There is a wide and diverse pool of private market companies that can offer potential diversification benefits. (7)

Below are three examples of diversity within the private equity category:

Private Infrastructure

Private infrastructure involves securing private capital to finance the development of essential infrastructure, encompassing the physical structures, facilities, and systems necessary for the functioning of economies and societies.

Private Credit

Private credit involves investing in privately negotiated loans provided by non-bank lenders to middle market companies that are generally not publicly traded.

Private Real Estate

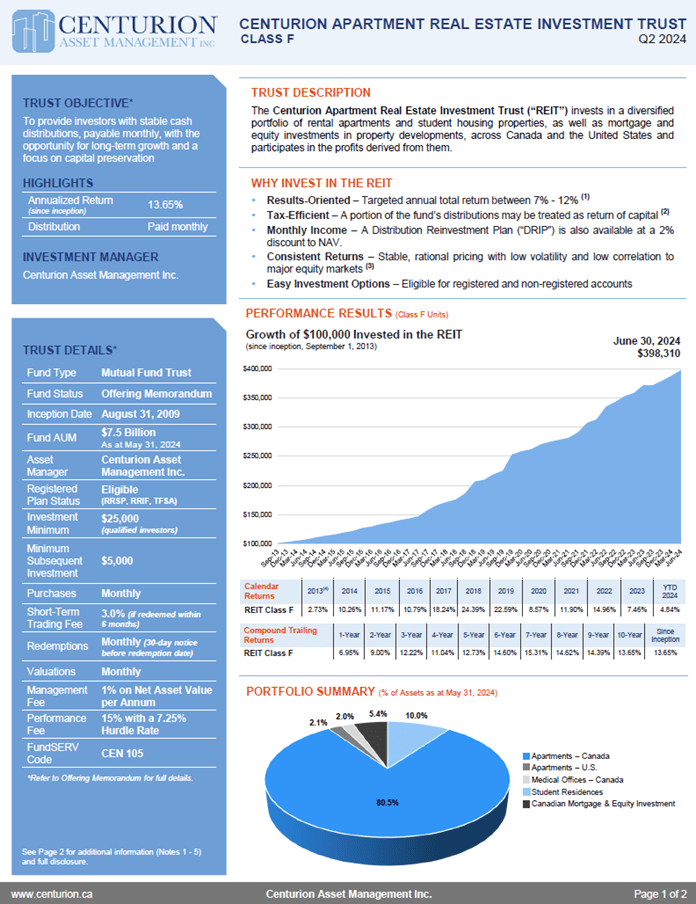

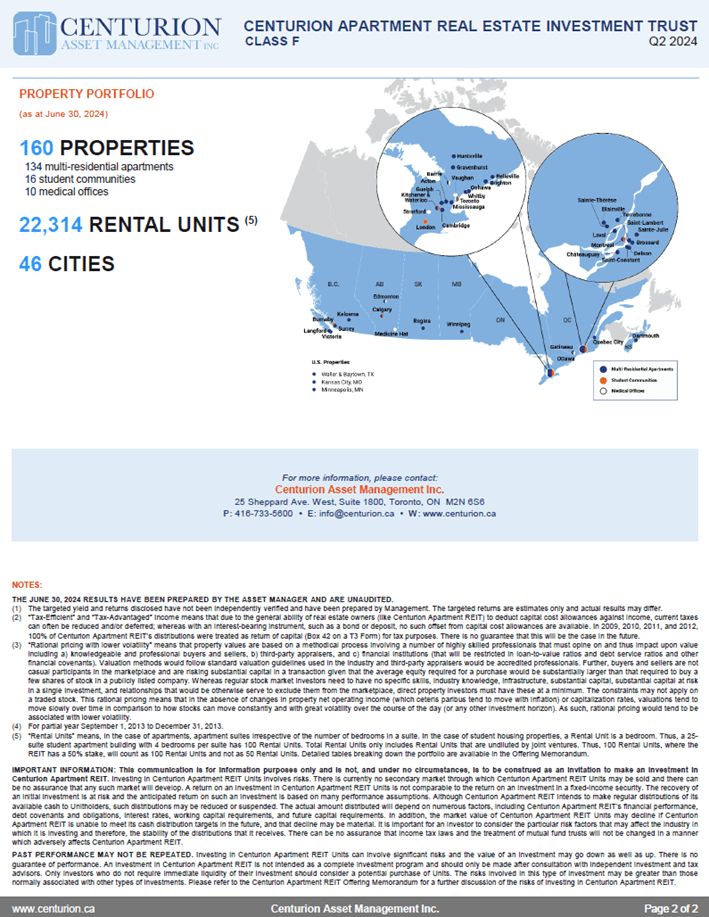

Private real estate involves investing in properties that are privately owned and managed by individuals, partnerships, or private companies, rather than being publicly traded on the stock market.

Investing in private real estate offers several advantages:

- High Potential Returns: Private real estate investments can yield significant returns through rental income, lease payments, and property value appreciation (8).

- Diversification: Including private real estate in a portfolio can provide diversification benefits, reducing overall investment risk due to its low correlation with public equities and bonds (8,9).

- Tax Benefits: Investors can take advantage of various tax deductions, such as property depreciation, which can enhance overall returns (10,8).

- Inflation Hedge: Real estate often acts as a hedge against inflation, as property values and rental incomes tend to increase with inflation (11,9).

- Access to Unique Opportunities: Private real estate investments can offer access to unique properties and markets that are not available through public real estate investment trusts (REITs). (8)

How to Get Started

If this sounds like the type of investment that could be well suited for your portfolio, or you have any questions at all, please reach out to Dave Novak at Vista Financial Group. We are pleased to offer an alternative to the basic investment portfolio, something that has been tried and tested by the giants of pension planning and that we can make work for you.

*Securities-related products and services are offered through Raymond James Ltd., Member - Canadian Investor Protection Fund.

Alternative investments are available only to those who meet specific suitability requirements including minimum net worth tests. Please review any offering materials carefully and consult with your tax advisor or accountant before investing. There are special risks involved with alternative investments, including liquidity, constraints, tax considerations, fee structures, potentially speculative investment strategies and different regulatory and reporting requirements. There can be no assurance that any investment will meet its performance objectives. No recommendation of any product or service would be made without a thorough review of an individual’s financial goals and risk tolerance.

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, David Novak, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision.