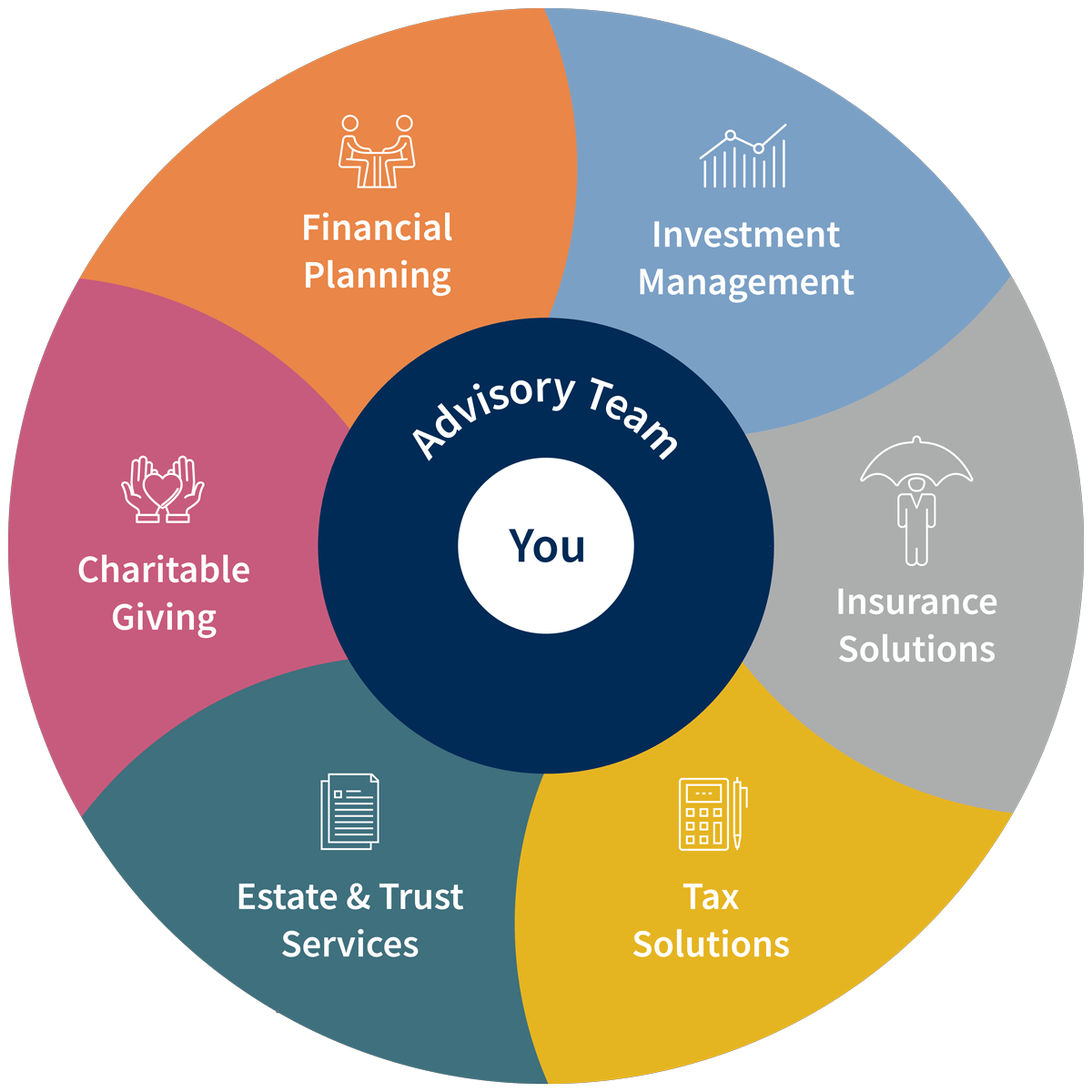

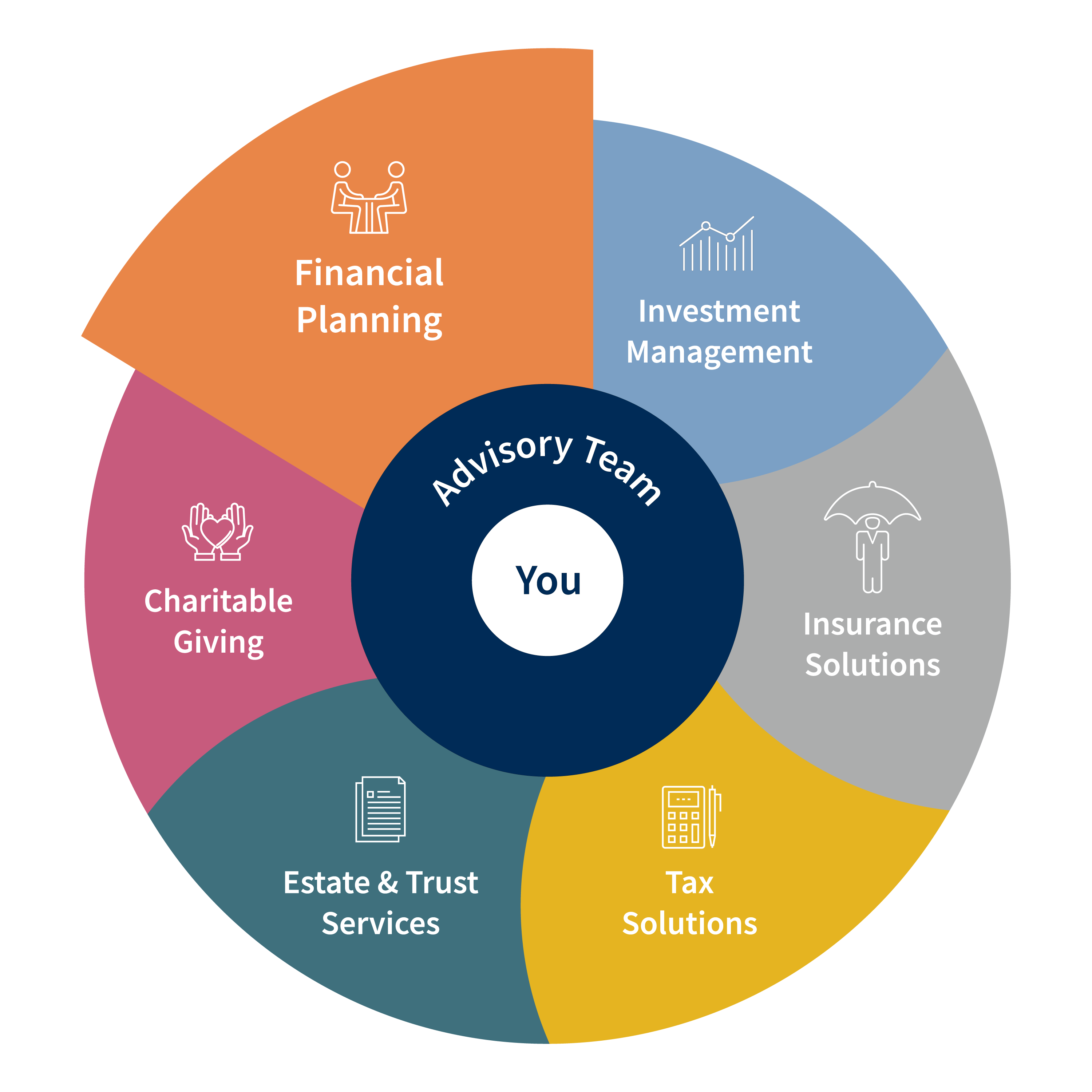

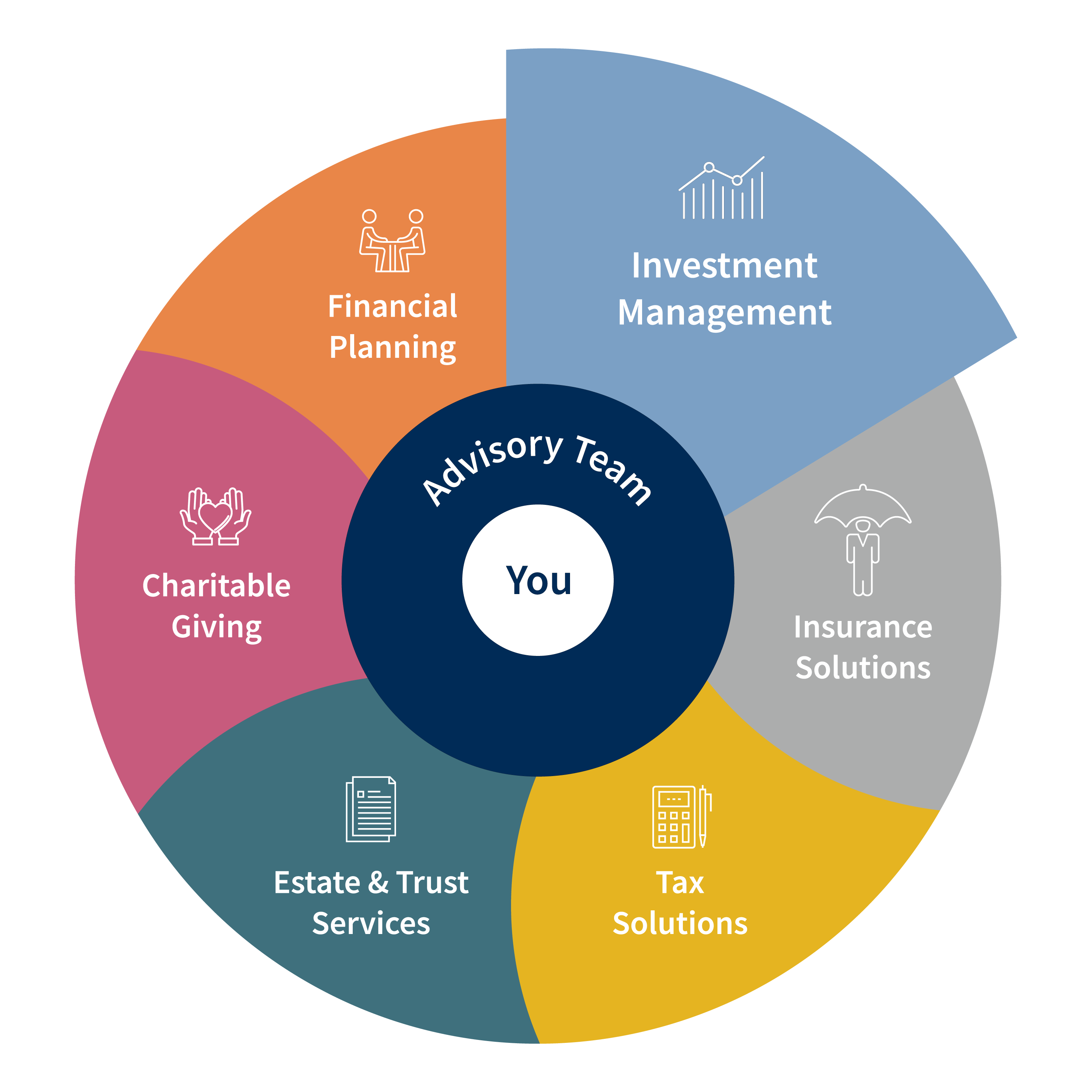

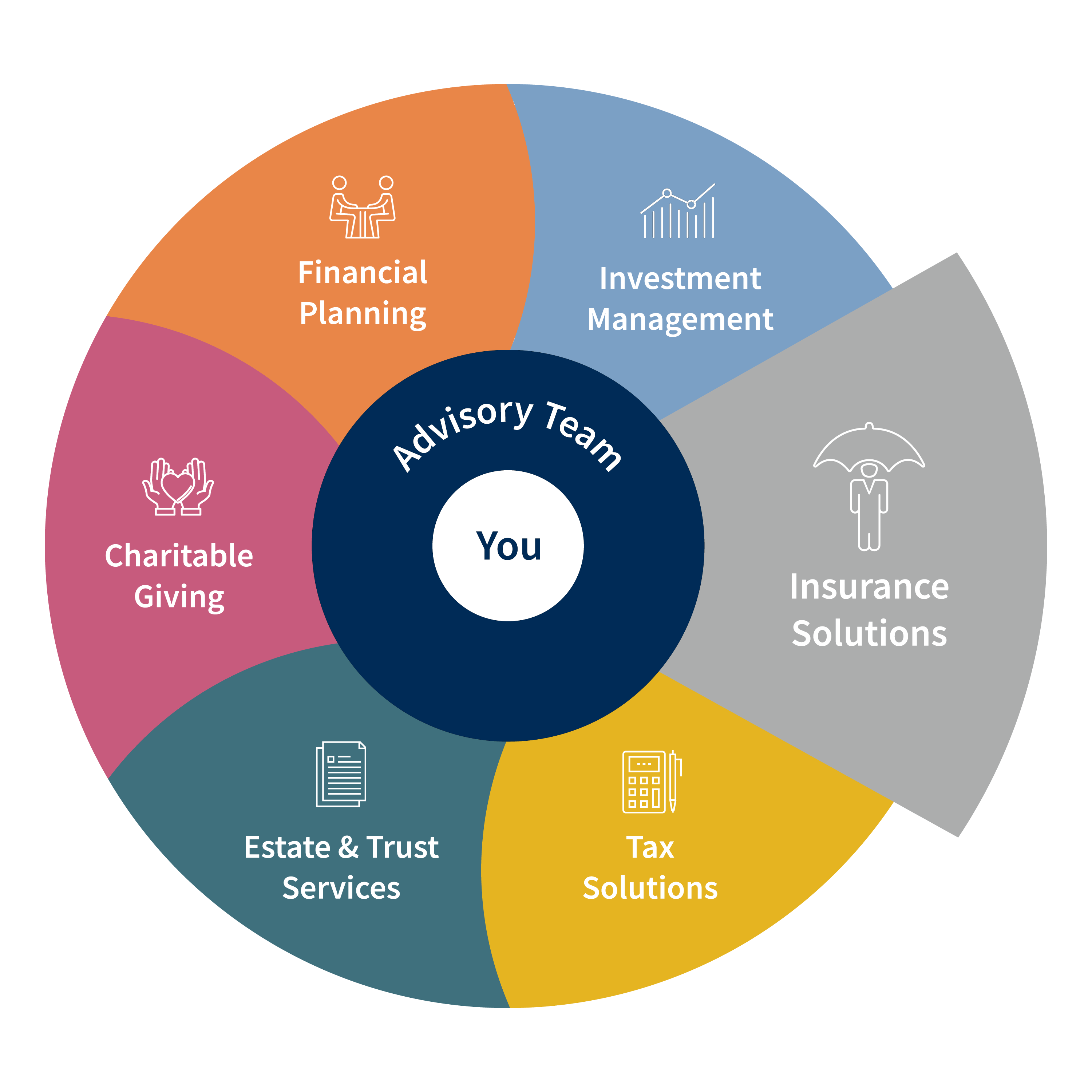

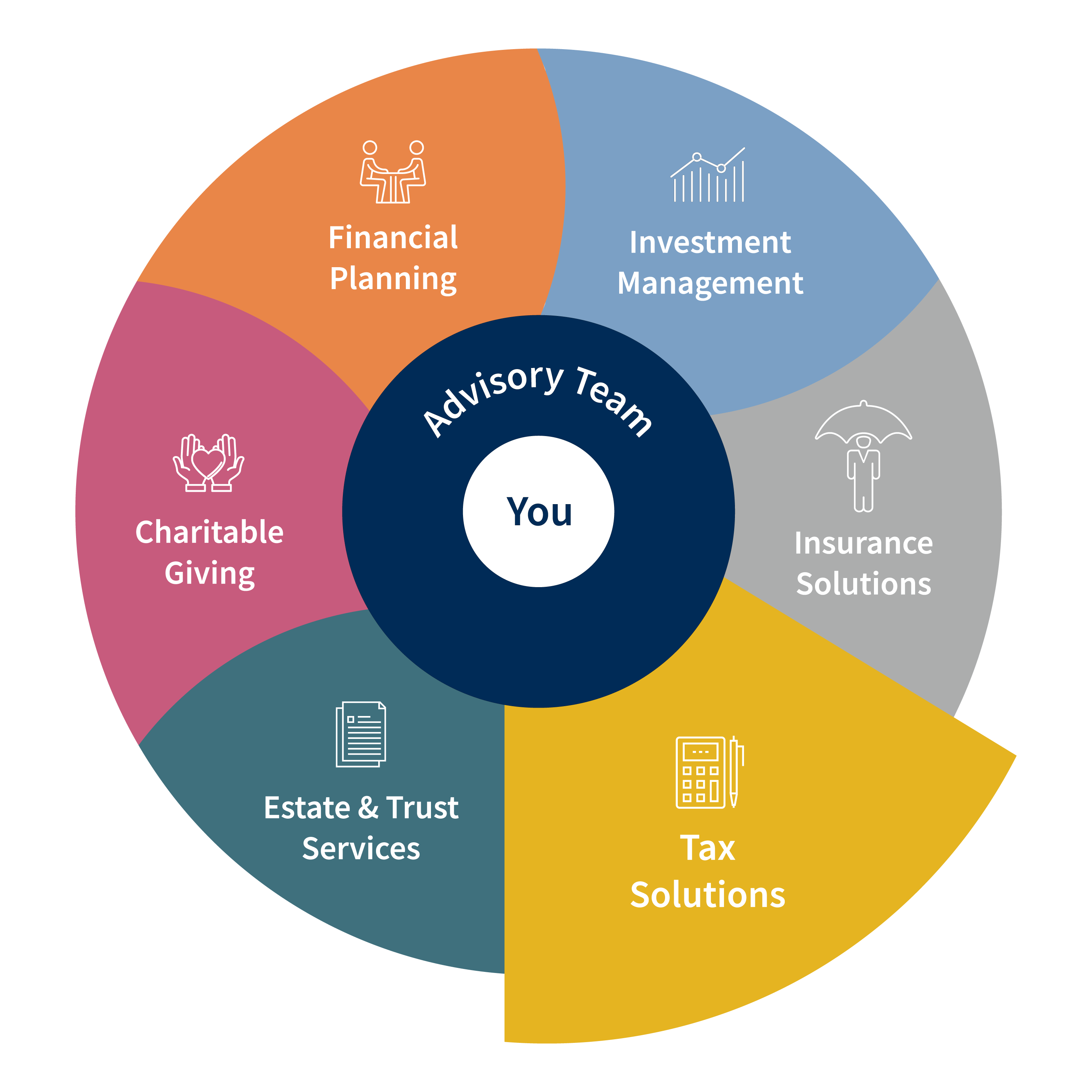

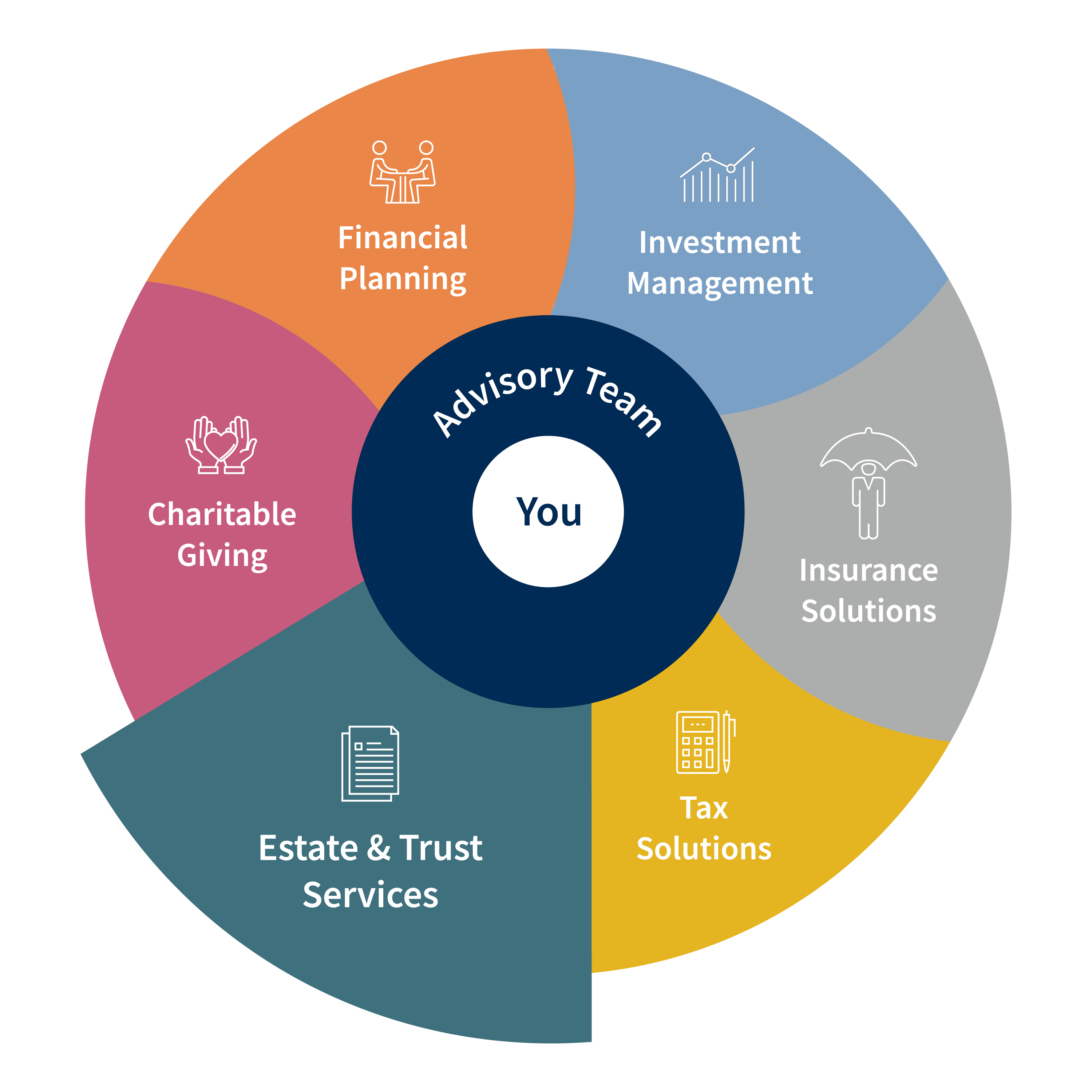

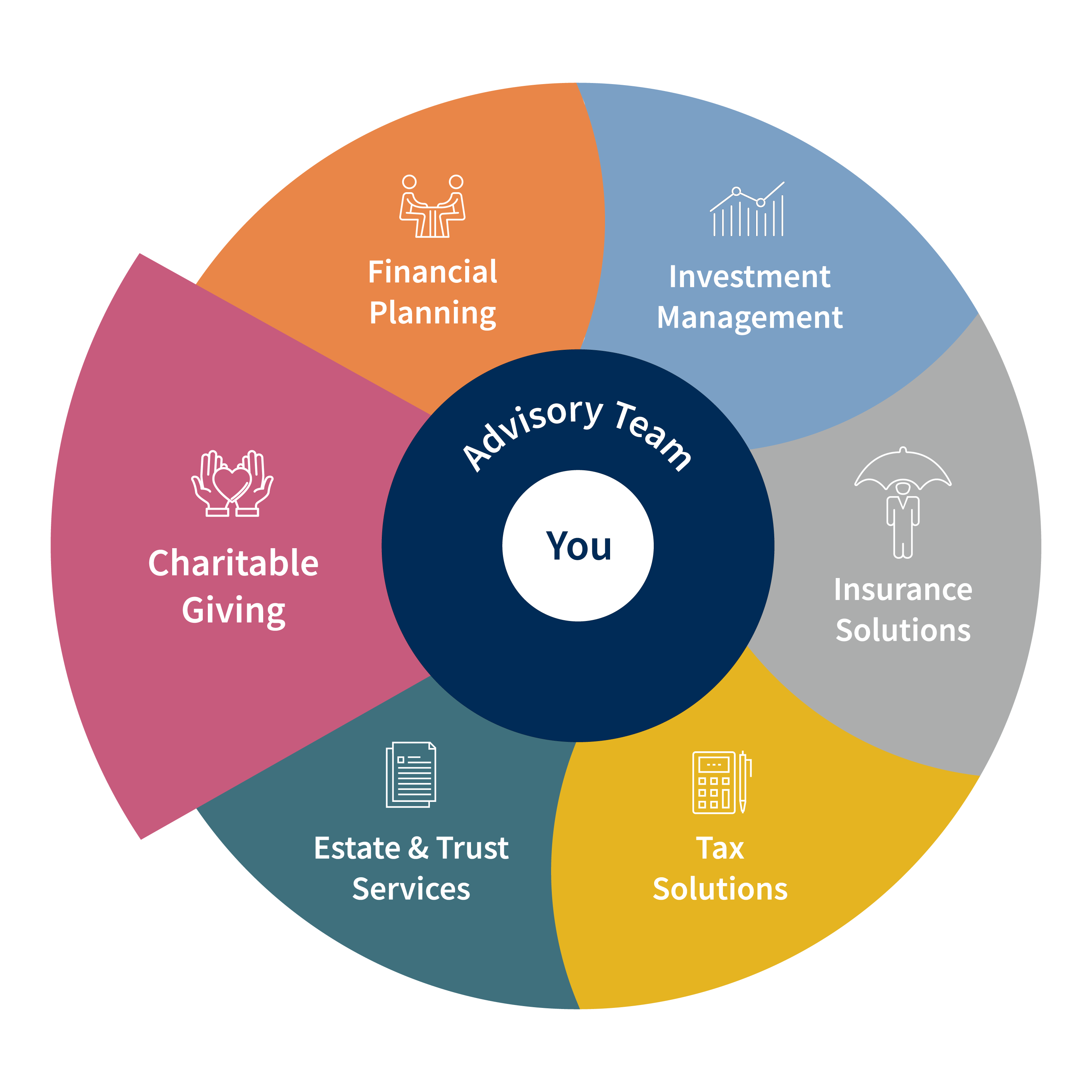

Total Wealth Solutions

Our business is you and your financial well-being

Through our Total Wealth Solutions approach, we collaborate with you and help you define and reach your financial goals at every stage of life. Whether you’re planning for retirement, growing a business, or transferring wealth to the next generation, we create a cohesive strategy that provides the best solutions to fit your individual needs.

Empower your wealth journey with personalized advice from our dedicated team of specialists that help incorporate:

-

Financial planning is the foundation upon which your total wealth management strategy is built and defined. A well-crafted plan for your life is where the discovery journey begins.

- Establish what wealth means to you

- Determine your goals and objectives

- Create a customized plan

- Execute action items to make your goals a reality

-

Investment management solutions are available to help build your net worth, preserve it or generate income for life. Through a deep discovery process, we will have the important conversations that help define what wealth means to you; how you want to spend and how you want to invest.

- Determine investment objectives, risk tolerance and time horizon

- Construct an appropriate asset allocation strategy

- Evaluate and select suitable investments

- Perform ongoing portfolio monitoring and rebalancing

-

Insurance solutions are critical to help guard against financial losses due to unexpected events. Providing for and safeguarding those you love from potential risks and uncertainties means building financial protection for them.

- Financially protect your family or business

- Accumulate and transfer wealth using tax-exempt life insurance

- Fund and facilitate a business transfer or continuity cost-effectively

- Guarantee income for life

- Group plans and solutions for businesses and corporations

-

Tax planning is an integral component of wealth management. Its purpose is to help you retain more of the wealth you have worked diligently to earn.

- Minimize tax liability and preserve wealth

- Prepare and file your tax return

- Identify restructuring opportunities to maximize wealth

- Make informed financial decisions

-

Estate and trust services help facilitate your wealth transfer wishes now and in the future. Whether acting as an executor, trustee or power of attorney, Solus Trust an affiliate of Raymond James Ltd. provides expertise to create lasting and meaningful legacies.

- Maintain family harmony

- Ensure diligent care of beneficiaries

- Preserve wealth and avoid financial vulnerability

- Facilitate legacies for generations to come

-

Charitable giving is a positive, life-affirming endeavor. It allows you to give with intention today and leave your mark for the future as you build a lasting legacy.

- Create your family foundation

- Build a charitable legacy

- Maximize impact to your favorite charities

- Initiate a strategic approach to giving