We are guided by three fundamental principles:

Our clients worked hard for their money. To build their businesses or careers they took risks, which resulted in their prosperity. Having attained wealth, they rightly wish to preserve it.

We agree. Considerable work and sacrifice went into building our clients’ wealth and now it should be safeguarded. That is why our investment philosophy is based in the management of risks, not the management of returns. We focus on downside protection when the markets are difficult and the provision of consistent, steady returns on the upside.

In the 2008 financial crisis, when markets saw declines of 50% from top to bottom, investors experiencing that drawdown needed to make 100% just to get back to breakeven. If they had controlled the downside, they would have missed the majority of the decline, and reasonable growth on the upside would have put them much further ahead.

Ultimately, focusing on preserving capital and managing downside risks means you don’t have to beat the markets every year to outperform over the long run. As we know, from Aesop’s fable of the tortoise and the hare, “slow and steady wins the race”.

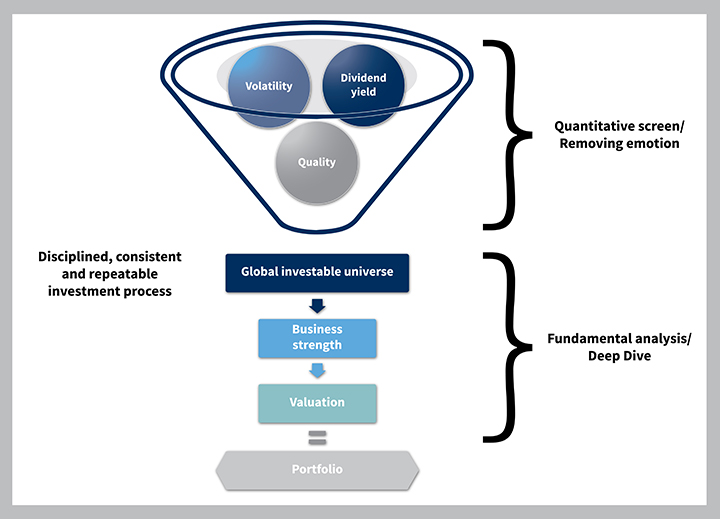

Our approach relies on a disciplined, consistent and repeatable process.

It begins with an assessment of your overall asset allocation from a tax efficiency standpoint and sheltering as much as possible from the taxman. From there we build the portfolio.

We believe in a disciplined pension-style approach to portfolio management, so the portfolio is built with an asset mix of individual equities and fixed income, exchange-traded funds (ETFs) and alternative funds. This combination of active and passive strategies ultimately helps us manage risks and smooth out returns.

We seek high quality investments that we are comfortable holding over the long-term. When buying individual companies, we look for predictable businesses with high barriers to entry. In other words, we buy companies with economic moats and therefore protection from competitors.

We also maintain objectivity by diversifying with different managers inside the portfolio. This gives our clients exposure to:

Simply put, your portfolio gets exposure to many specific areas of the market so that you don’t miss out when one style happens to be performing better than another.