eBook

Costly Financial Mistakes

And How to Avoid Them

Composed by:

Adam McHenry, CFA, MBA

Portfolio Manager, Raymond James Ltd.

&

Adam Sieniakiewicz

Research Intern

Introduction

Navigating the landscape of personal finance can often feel like quicksand, riddled with pitfalls and traps that, if not carefully avoided, can lead to financial hardship or even relationship breakdown. This eBook, “Costly Financial Mistakes and How to Avoid Them,” aims to highlight these common missteps and provide practical advice on how to sidestep them.

Our goal is to educate you with the knowledge and tools necessary to make informed financial decisions and to help you build a solid foundation for a secure financial future. By understanding these common mistakes, you can take proactive steps to avoid them, paving the way towards financial success and stability.

Remember, nobody is immune to financial mistakes, but with knowledge and planning, they can certainly be mitigated.

1. Budget – General

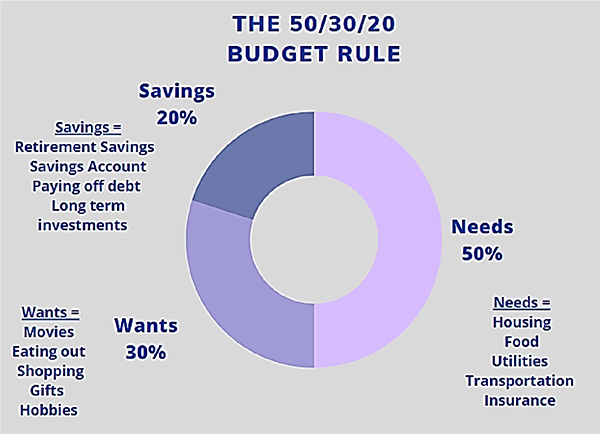

Having a budget is a crucial for achieving financial success and stability. Budgets serve as a financial overview or roadmap, which helps you manage your income expenses and savings. Without a budget its hard to keep track of where your money goes each month, which can often lead to overspending and financial stress. By providing a clear view of income versus expenses, a budget allows you to make informed decisions, prioritize financial goals, and ultimately achieve financial independence and peace of mind. Diagram #1

Nowadays, people often overlook the importance of a budget. Instead of planning for the future, they want to live in the now, often leading to poor financial decisions early in life that hurt them in the future.

The most common budgeting technique is the 50/30/20 rule, which was popularized in the book “All Your Worth: The Ultimate Lifetime Money Plan.”.

The 50/30/20 rule states that you should spend 50% of your after-tax income on needs, 30% on wants, and 20% on savings. (See Diagram #1)

While this is a universally good rule of thumb, budgeting could become much more complex, and may have to be adjusted due to factors such as one’s age, family situation, income, debts, and stage of their professional career.

2. Budget – Live Within Your Means

Living within one’s means is a fundamental aspect of financial health and stability. It is the practice of spending less than what you earn, allowing you to avoid debt, save for the future, and feel more secure in your financial situation.

Sounds simple? It is, yet more than half of Canadians (54%) say they are living paycheck to paycheck. And this isn’t just an issue for lower-income earners, this trend continues across all income levels. As people start to earn more, they often raise their standard of living in accordance with their earnings to where they are still paycheck to paycheck.

When you live within your means, you provide yourself with a financial buffer against unforeseen expenses, job loss, or other financial emergencies. Moreover, it promotes financial independence and provides peace of mind, as you’re not constantly worried about making ends meet or accruing more debt.

3. Budget – Save!

Saving is a critical financial habit that contributes to long-term financial security and stability. It enables individuals to plan for future expenses, whether expected like retirement, or unexpected like emergency medical costs. Moreover, having a robust savings account can provide a sense of financial freedom, reducing stress associated with living paycheck to paycheck.

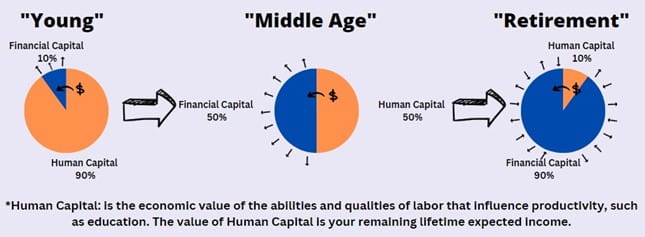

Diagram 2:

Despite these advantages, many Canadians struggle to save enough. This is often due to a combination of factors such as high cost of living, stagnating wages, consumer culture encouraging spending, and lack of financial literacy. Many people underestimate the importance of saving or find it difficult to do so after covering essential expenses. Addressing this issue requires a multifaceted approach, including improving financial education, encouraging better money management habits, and advocating for policies that enhance economic stability.

Simply think of saving as the mechanism that lets you transfer wealth from your human capital (employment) to your financial capital (RRSP, TFSA, etc.). The size of the pie dictates your wealth and lifestyle. (See Diagram #2)

4. Understand Taxes

Understanding Canada’s tax code is an essential part of sound financial management and investment decision-making. Tax laws and regulations can significantly impact personal income, investment returns, and overall wealth. For example, by understanding how tax brackets work, Canadians can make strategic decisions about income deferral or income splitting to minimize their tax liability.

Furthermore, knowledge of tax-advantaged accounts like the Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA) can guide investment decisions. Investing in these accounts can result in substantial tax savings over time. For instance, contributions to RRSPs can be deducted from your taxable income now, which could move you to a lower tax bracket, while growth and withdrawals from a TFSA are tax-free. The First Home Savings Account (FHSA) combines the factors of both for a first home purchase.

Therefore, a comprehensive understanding of tax planning can lead to more informed financial decisions, resulting in increased savings and wealth accumulation over time.

5. Understand Debt – Understand good debt vs. bad debt

Diagram 3:

Understanding the nature of debt is crucial for robust financial health. Not all debts are created equal, and distinguishing between ‘good debt’ and ‘bad debt’ is key to effectively leveraging debt for financial growth.

“Good debt” is typically associated with investments that generate long-term value or income. For example, a mortgage for a home can be considered good debt, as real estate usually appreciates over time, increasing your net worth. After all, you do need to live somewhere, and real estate in Canada has proven historically to be a stable and growing asset. Similarly, student loans can be classified as good debt, as the education acquired can lead to higher earning potential. (See Diagram #3)

On the other hand, “bad debt” often involves borrowing for consumable goods or depreciating assets, such as credit card debt used for daily expenses or a high-interest auto loan for a new car. These debts do not generate wealth and can trap individuals in a cycle of high-interest payments. (See Diagram #3)

Therefore, it’s important to manage and limit bad debts while strategically using good debts as financial tools. By understanding the differences and knowing how to manage and leverage debt, individuals can work towards financial stability and prosperity.

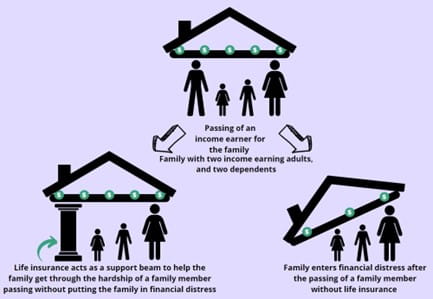

6. Importance of Insurance

Insurance plays a pivotal role in safeguarding our financial future. It’s a protective measure that helps mitigate potential financial risks, providing a safety net for unforeseen circumstances. Life insurance, in particular, is crucial as it offers financial protection to your loved ones after your passing, making a difficult situation a little more manageable. It ensures that your loved ones are not burdened with your debts or left in a financially tricky situation causing them to drastically reduce their standard of living that they are accustomed to. (See Diagram #4)

Consider, for instance, a family where one parent is the primary breadwinner. If that person were to pass away unexpectedly without life insurance, the family could struggle financially, having to deal with mortgage payments, debts, and daily expenses without their primary source of income. (See Diagram #4)

Hence, while insurance might seem like an unnecessary expense when times are good, it’s indispensable in protecting you and your family against life’s unpredictable turns, and should be seen as a critical component of your overall financial plan.

Diagram 4:

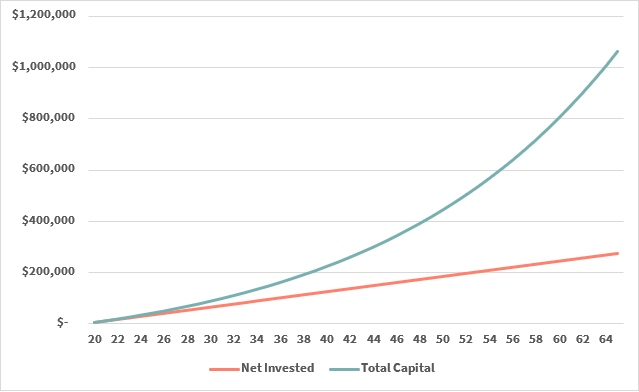

7. Invest Early

The significance of beginning your investment journey early can’t be overstated. This is largely due to the power of compounding, where you earn returns not only on your initial investment but also on the returns that your investment generates. The earlier you start investing, the more time your money has to compound and grow. (See Diagram #5)

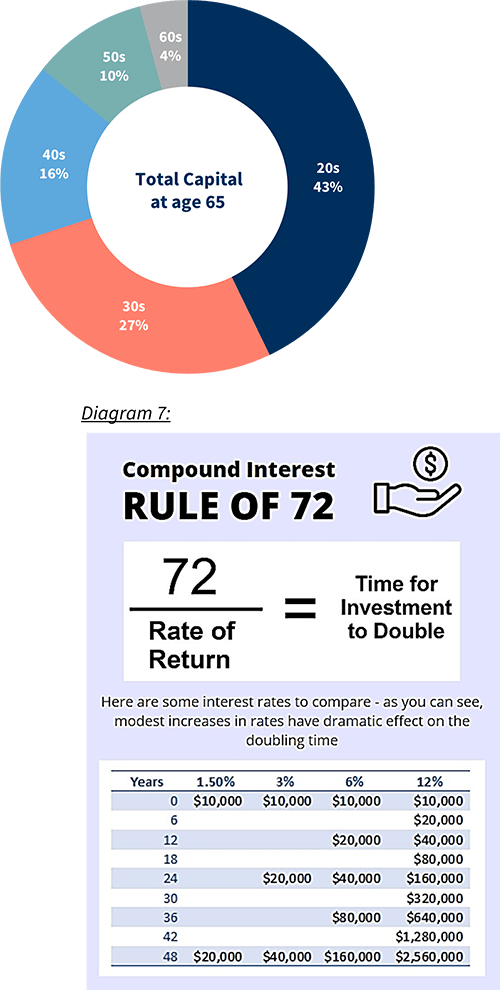

The following analysis illustrates the importance of investing early in life, demonstrating that approximately 70% of total capital at age 65 comes from money invested in your 20s and 30s. (See Diagram #6)

- The analysis assumes individual invests $6,000 per year (or $500 a month) from age 20 to 60, invested until age 65 with a rate of return of 5% per year on average. (See Diagrams #5 & #6) Diagram 5:

Diagram 6:

Furthermore, the ‘Rule of 72’ is a simple way to demonstrate the importance of starting to invest when you’re young. This rule states that you can estimate the number of years it will take for your investment to double by dividing 72 by your expected annual rate of return. For instance, if you expect a return of 6% per year, your investment would double in approximately 12 years (72/6). If you start investing at age 25, you could see your money double several times before retirement at 65. Conversely, if you wait until you’re 45 to start investing, your money might only double once or twice before retirement. (See Diagram #7)

This illustrates why “time” can be one of the most valuable assets when it comes to investing.

8. Overreliance on Future Earnings

Relying too heavily on future earnings is a financial pitfall that can have serious repercussions. It’s easy to fall into the trap of assuming that as you progress in your career, your income will steadily increase, allowing you to afford more expensive lifestyle choices or to pay off debt incurred today. However, this approach disregards the unpredictable nature of life and the economy. Economic downturns, job losses, health issues, or unexpected expenses can quickly derail your financial situation.

Overreliance on future income also tends to discourage current saving and investing, which are critical to financial stability and wealth building. For instance, if you take on a large mortgage assuming your income will increase, but then face a job loss, you could end up in a precarious financial situation.

Therefore, it’s important to base your financial decisions on your current income and savings, while also planning and investing for the future, to ensure you have a safety net for unforeseen circumstances, and that you are taking advantage of longer-term compounding. (See Diagram #5 & #6)

9. Plan Early for Retirement

The importance of planning for retirement early cannot be overstated. By starting to financially plan for retirement early, one can allow for more time for their investments to grow though the magic of compound interest, which leads to greater returns, and ultimately a more comfortable and secure retirement.

Early planning for your retirement also provides you with a clear picture of your retirement goals, giving you ample time to adjust your strategies and savings plan, if needed. This also leaves you with more time to anticipate and prepare for potential financial challenges that may arise in retirement, such as increasing healthcare costs, or the ever-increasing cost of living. Unfortunately, many Canadians underestimate the amount they will need for retirement, leading to financial stress in their later years.

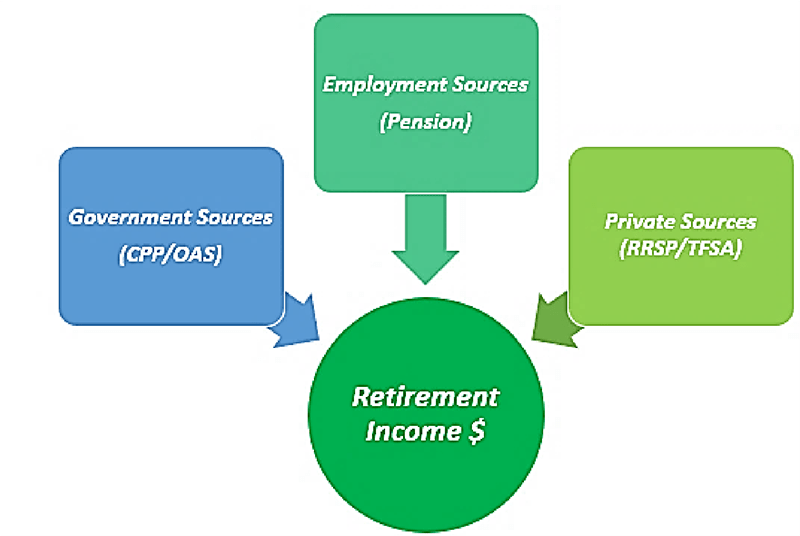

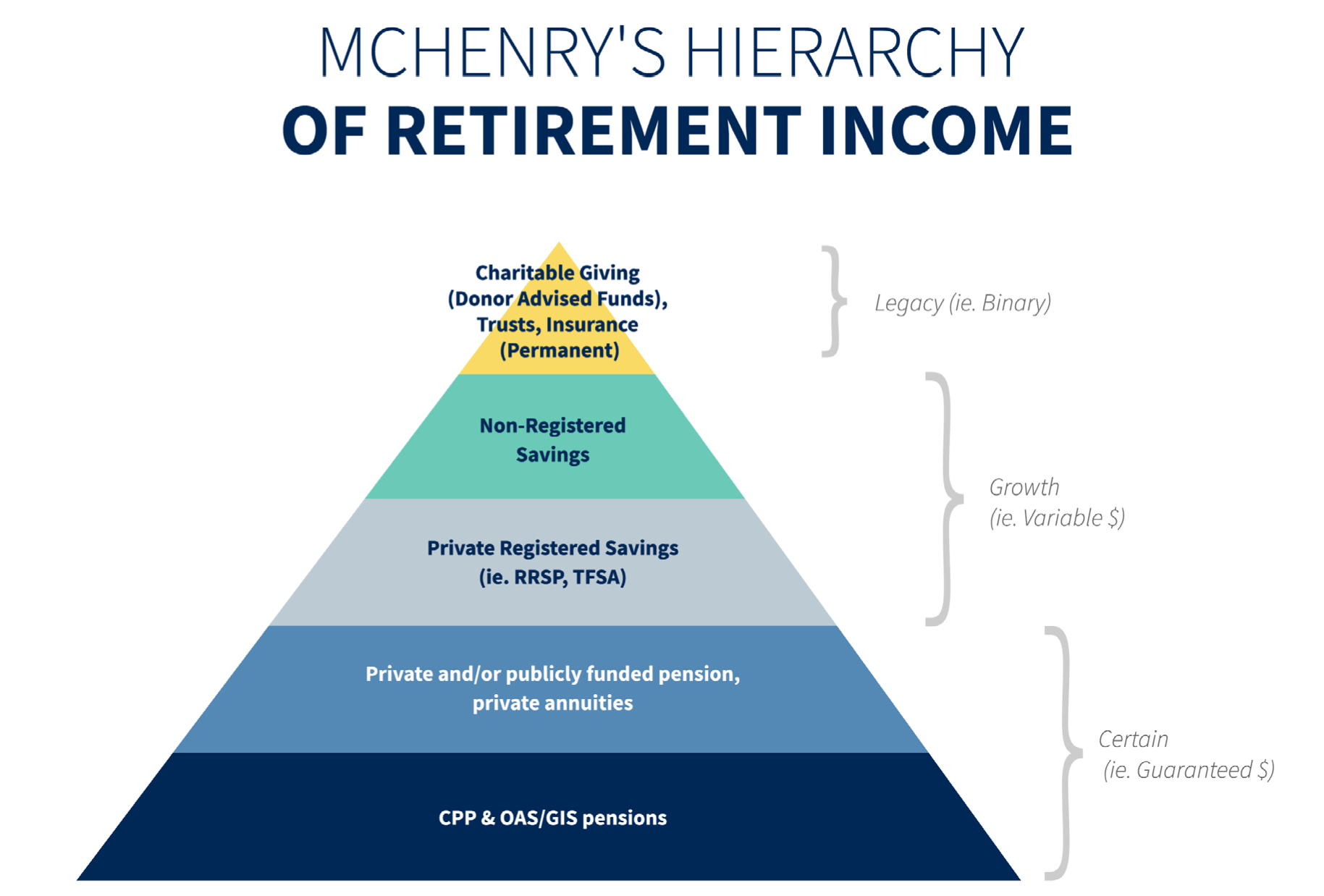

It is important for Canadians to understand the three main sources of retirement income, and how to maximize their benefit in retirement. (See Diagram #8)

The three main sources are:

- Government Sources – such as CPP, OAS, and GICs

- Employment Sources – such as one’s Employer Pension

- Private Sources – such as ones RRSP and/or TSFA Diagram 8:

How one should address each one of these sources is usually determined on a case-to-case basis. It would be highly recommended that individuals start to work with a financial advisor that understands them and their situation. (See Diagram #9) Diagram 9:

10. Have an Emergency Fund

Having an emergency fund is a critical aspect of any sound financial plan. This is a safety net of money set aside to cover the financial surprises life throws your way. These unexpected events can be stressful and costly, such as losing your job, experiencing a sudden illness, or having to carry out major car or home repairs.

By having an emergency fund, you’re providing yourself with the financial security and peace of mind knowing that you can handle these unexpected expenses without resorting to loans, credit card debt, or tapping into your retirement savings. An emergency fund not only offers you monetary support in times of crisis but also allows you more freedom to make choices in your life because you’re not constantly living in fear of financial ruin. It can make all the difference between a minor financial setback and a major, longlasting crisis. Therefore, building an emergency fund should be a priority for all Canadians.

Recommended emergency fund sizes, however, will vary based on many factors, such as number of dependants, job stability, or whether you’re self-employed. A general rule of thumb is to have six months expenses saved up, should any unforeseen circumstances occur.

11. Falling for Financial Scams

Financial scams pose a significant risk to individuals and their hard-earned money. These are deceptive schemes that manipulate people into making detrimental financial decisions. These scams often allure individuals with enticing, but usually unrealistic promises of high returns or other financial benefits.

Multi-Level Marketing (MLM) schemes are a common example, where individuals are drawn into a business model that primarily profits from recruitment rather than the sale of products or services. Often, participants find themselves incurring losses rather than the promised profits.

Additionally, guaranteed returns on investments, often advertised with eye-catching claims, pose another risk. Genuine investments carry risk and any promise of guaranteed returns is typically a red flag for investments not issued by a government entity (ex. GIC- Guaranteed investment Certificate).

Cryptocurrency scams have also emerged as a significant threat in the digital era, leveraging the buzz around cryptocurrencies and blockchain technology to defraud unsuspecting individuals. Protection from these financial scams requires a combination of skepticism, knowledge, and due diligence.

Always thoroughly research any investment opportunity, understand the associated risks, and seek advice from trusted financial advisors. It’s crucial to remember that if an investment opportunity sounds too good to be true, it likely is!

12. Ignoring Professional Benefits/Savings Plans

Many Canadians are not fully aware of the range of benefits offered by their employers, which can be a missed opportunity to improve their financial situation. Company benefits often extend beyond just health insurance to include various other financial incentives. One such common benefit is RRSP matching, where employers contribute a certain amount towards an employee’s Registered Retirement Savings Plan (RRSP) for every dollar the employee contributes, effectively providing “free money” for retirement. However, these benefits often come with certain conditions, such as a vesting period, which is a period of time the employee must work at the company before they are entitled to these employer-contributed funds. For instance, a company might require an employee to be with the company for two years before they can access the company’s matching contributions in their RRSP.

Unfortunately, due to lack of awareness or understanding, these benefits often go underutilized. It is crucial for employees to familiarize themselves with their company’s benefits program and take full advantage of it. If unclear, employees should reach out to their human resources department or benefits coordinator to get a better understanding of what is available to them. By leveraging these benefits, employees can bolster their financial stability and financial health.

13. Have a Financial Advisor that suits you!

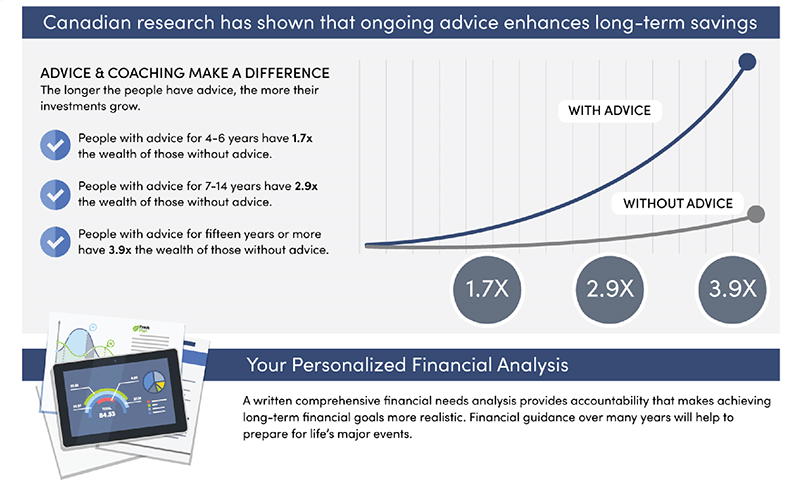

Despite a prevalent perception that financial advisors are only for the affluent, research indicates that a significant number of individuals across all income brackets lack a financial advisor—and this is a critical misstep. Navigating the complex world of finances can be overwhelming, even for those with a basic understanding of financial principles.

Diagram 10:

A competent financial advisor brings their expertise to the table, helping you plan and strategize your financial future, making informed decisions about investments, savings, taxes, retirement planning, and more. They offer personalized advice based on your unique circumstances and financial goals. Additionally, they can provide you with a holistic view of your financial situation, highlighting potential areas for improvement or risk mitigation. (See Diagram #10)

Not only can they help prevent costly mistakes, but they can also optimize your wealth growth, adding value that far exceeds their cost. It is this potential for improved financial health and security that underscores the importance of having a financial advisor. (See Diagram #10)

14. Estate Planning - Have a Will and Powers of Attorney

The importance of having a legally executed will cannot be stressed enough. A will is a legal document that outlines your wishes regarding the distribution of your assets upon your death. Without a will, the disposition of your estate is determined by the rules of intestacy under Ontario’s Succession Law Reform Act, which may not align with your personal wishes. Consequently, your loved ones may be left in a precarious situation.

Furthermore, when an estate enters into probate without a will, it can often be a time-consuming, expensive, and emotionally draining process for your heirs, possibly leading to family conflict. In addition, the fees and taxes associated with intestate succession can deplete the value of your estate. Therefore, a well-structured will is not just a document; it’s a crucial financial planning tool that helps protect your assets, minimize estate taxes, and ensure your loved ones are provided for in the way you intended.

A well-structured will can provide significant financial and emotional benefits for your family after your passing. Here’s how:

- Clear Distribution of Assets: A will clearly outlines who gets what, preventing disputes over assets. This clarity can save heirs from stressful and potentially costly legal battles.

- Minimizing Probate Fees: By correctly structuring your will, and possibly setting up trusts, you can minimize the amount of your estate that has to go through probate, thereby reducing probate fees.

- Tax Planning: A well-structured will can also be a useful tool in estate tax planning. It can help to maximize tax advantages and minimize the estate’s tax liability, thus preserving the value of your estate for your heirs.

- Providing for Minors: If you have minor children, a will allows you to establish trusts for their benefit, nominate their legal guardians, and make financial arrangements for their upbringing, thereby ensuring their well-being and reducing stress on other family members.

- Charitable Giving: If you wish to leave a legacy through charitable donations, these can be set up in your will in a tax-efficient manner.

- Avoiding Intestacy: Dying without a will (intestate) often results in a more extended, more complex, and more costly process to settle the estate. This causes additional stress and financial burden for the family.

- Prompt Distribution: A clear will can speed up the process of distributing your assets, as there are fewer chances for disputes or confusion, allowing your heirs to receive their inheritance quicker.

- Executor Appointment: In your will, you appoint an executor who you trust to manage and distribute your estate as per your wishes. This can avoid potential conflicts that could arise if the court had to appoint an administrator.

Remember, laws regarding wills and estates vary, so it’s essential to consult with a legal professional when creating or updating your will.

Summary

In conclusion, planning for your financial future can be a daunting task, but it doesn’t have to be. With the right support and advice, you can take the necessary steps today to ensure your prosperity and peace of mind for tomorrow.

As a Portfolio Manager and Financial Advisor with two decades of experience in wealth management, I am uniquely equipped to guide you on your journey to financial success. I believe in taking a comprehensive approach, focusing on understanding your unique financial situation, lifestyle, goals, and risk tolerance, to create a tailored investment strategy just for you.

But don’t just take my word for it. Experience the benefit of expert financial advice firsthand with a complementary consultation. We will look at your current investments, discuss your financial goals, and outline the ways we can make your money work harder and smarter for you.

Your future is in your hands, and the decisions you make today can shape the rest of your life. Why not make sure you’re on the path to success? Reach out today, and let’s start planning for your financially prosperous future together.

Remember, planning ahead is not just about protecting your wealth; it’s about creating a legacy, safeguarding your loved ones, and enjoying the peace of mind that comes from knowing you’re prepared for whatever the future may bring. Don’t delay – the first step towards your financially secure future is just a phone call or an email away.

Contact me, Adam McHenry at adam.mchenry@raymondjames.ca or 416-901-6500.

Sources:

- “Making a Budget.” Government of Canada, Financial Consumer Agency of Canada, canada.ca/en/financial-consumer-agency/services/makebudget.html.

- Kenton, Will. “What Is the 50/20/30 Budget Rule?” Investopedia, 30 July 2021, investopedia.com/ask/answers/022916/what-502030-budget-rule.asp.

- Judd, James. “More Canadians Living Paycheque to Paycheque with Growing Debt.” Wealth Professional Canada, 22 July 2023, wealthprofessional. ca/news/industry-news/more-canadians-living-paycheque-to-paycheque-with-growing-debt/370284.

- “Rule of 72.” First Florida Credit Union, 2 Oct 2019, syscoi.com/2019/10/02/rule-of-72-first-florida-credit-union/.

- “Employee Benefits.” RPP Benefits, rppbenefits.com/employee-benefits/.

- Sethi, Ramit. I Will Teach You To Be Rich. Workman Publishing, 2021.

- Warren, Elizabeth, and Amelia Warren Tyagi. All Your Worth: The Ultimate Lifetime Money Plan. Free Press, 2006.

- Stanley, Thomas J. The Millionaire Next Door: The Surprising Secrets of America’s Wealthy. Taylor Trade Publishing, 2010.

- Chilton, David. The Wealthy Barber. Prima Lifestyles, 1997.

- “The EY Tax Guide 2022.” Ernst & Young, Wiley, 2022.

- Kiyosaki, Robert. Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!. Plata Publishing, 2017.

- Steuer, Tony. GET READY!: A Step-by-Step Planner for Maintaining Your Financial First Aid Kit. Lifehacks Press, 2023.

- Graham, Benjamin. The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel. HarperBusiness, 2006.

- Orman, Suze. The Money Class: How to Stand in Your Truth and Create the Future You Deserve. Spiegel & Grau, 2012.

- Hallam, Andrew. Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School. Wiley, 2017.

- Ramsey, Dave. The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness. Thomas Nelson, 2013.

- Abagnale, Frank. Scam Me If You Can: Simple Strategies to Outsmart Today’s Rip-off Artists. Portfolio, 2019.

- Bach, David. Smart Couples Finish Rich, Revised and Updated: 9 Steps to Creating a Rich Future for You and Your Partner. Crown, 2018.

- “Taxes.” Government of Canada, Canada Revenue Agency, canada.ca/en/services/taxes.html.

- “Financial Literacy.” Government of Canada, canada.ca/en/services/finance/financial-literacy.html.

- “Statistics Canada.” Government of Canada, Statistics Canada, statcan.gc.ca/.

- “Employee Research Survey.” Canadian Payroll Association, payroll.ca/PDF/Resources/201.

- “Good Debt Vs Bad Debt.” Breaking Travel News, breakingtravelnews.com/focus/article/good-debt-vs-bad-debt/.

- “10 Reasons to Have a Will.” FreeWill, freewill.com/learn/10-reasons-to-have-a-will. Accessed 6 June 2023.

- “Top 10 Benefits of Having a Will.” Kosick Aggassiz Chartered Professional Accountants, kosickcpa.ca/top-10-benefits-of-having-a-will/.

- “5 Benefits to Creating a Will.” HG.org, hg.org/legal-articles/5-benefits-to-creating-a-will-24914. Accessed 6 June 2023.

- “The Importance of a Will and Power of Attorney.” University of Ottawa, uOttawa, [n.d.], https://www.uottawa.ca/giving/planned-giving/importance-willand-power-attorney.

- “The Benefits of Estate Planning.” Onyx Law Group, [n.d.], https://onyxlaw.ca/benefits-of-estate-planning/

- Shuman Law Firm. “Wills, Powers of Attorney & Estate Planning.” Shuman Law, [n.d.], https://shumanlaw.ca/wills-powers-of-attorney-estateplanning/#:~:text=416)%20225%2D5136-,Wills%2C%20Powers%20of%20Attorney%20%26%20Estate%20Planning,looks%20after%20your%20minor%20 children

Contact me, Adam McHenry, for your complementary, no obligation financial consultation!

Email me: adam.mchenry@raymondjames.ca Call me: 416-901-6500

Learn More: http://www.adammchenry.com/

- Portfolio Management

- Investment Strategies

- Financial Planning

- Longevity Planning

- Retirement Planning

- Education Planning

- Estate Planning and Strategic Charitable giving

- Cross Border Financial Advising