The Crucial Role of Partnering in Wealth Management Lessons from Silicon Valley Bank

Adam McHenry, CFA, MBA

Portfolio Manager, Raymond James Ltd.

The world of wealth management and financial advice underscores the necessity for a trustworthy and reliable financial advisor. Still, one element is often undervalued—the institutional backing that accompanies these professionals. Partnerships not only lends credibility to the advisor but also equips them with resources, stability, and a greater capacity to manage potential risks.

The dangers of entrusting one’s financial future to an advisor without substantial, strong partnerships are evident, more so when considered in light of recent financial history. When financial advisors operate without the anchor of a strong institution, the inherent risk is amplified, with the client’s investments left exposed to not just market uncertainties and instabilities, but also custody risks.

To bring this scenario to life, one needs to look no further than the collapse of Silicon Valley Bank (SVB) in Q1 of 2023. A specialized bank serving the technology sector and venture capital-backed startups, SVB was the 16th largest U.S. bank before its downfall. The bank’s collapse followed a period of mass layoffs in the tech sector in late 2022 and early 2023 and became the biggest bank failure since Washington Mutual in 2008.

The SVB catastrophe has had a significant impact on tech companies and startups. These institutions were reliant on the bank, which, despite having $209 billion in assets at the end of 2022, collapsed due to a bank run. The U.S.

government had to intervene to protect customer deposits.

Now, imagine if your financial advisor faced similar circumstances without the partnership with a robust institution. That would not be a pleasant feeling.

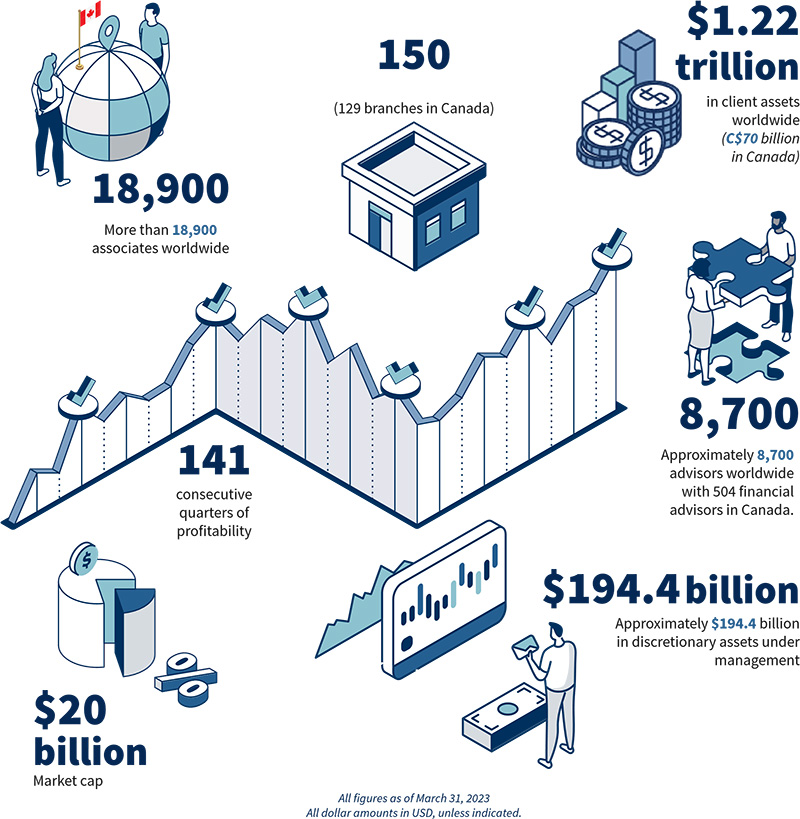

The compelling alternative is a financial advisor with strong partnerships, like us at Raymond James. Founded in 1962 and a public company since 1983, Raymond James manages approximately $1.22 trillion in client assets. Such financial strength is a testament to the company’s stability and reliability. This sum of $1.22 trillion aligns closely with the amount of client assets under management by the leading banking institutions.

The financial powerhouse, Raymond James has displayed remarkable resilience, with 141 quarters of consecutive profitability*. This kind of consistency underlines the effectiveness of the firm’s prudent risk management and its dedication to serving its clients.

Raymond James holds more than two times the required regulatory capital, providing an extra layer of protection for clients’ assets. Distinct from large-scale banking institutions that prioritize credit card services, lending operations, and the marketing of proprietary financial products, Raymond James concentrates solely on providing exceptional custodial services and addressing the unique needs of its clients.

In summary, the value of a financial advisor with robust partnership, like us at Raymond James, is undeniable. It provides stability, regulatory compliance, extensive resources, and protection against financial uncertainties. Therefore, ensuring your financial future is guided by an institution with the likes of Raymond James could be the cornerstone for a secure and prosperous financial journey.

Raymond James at a Glance

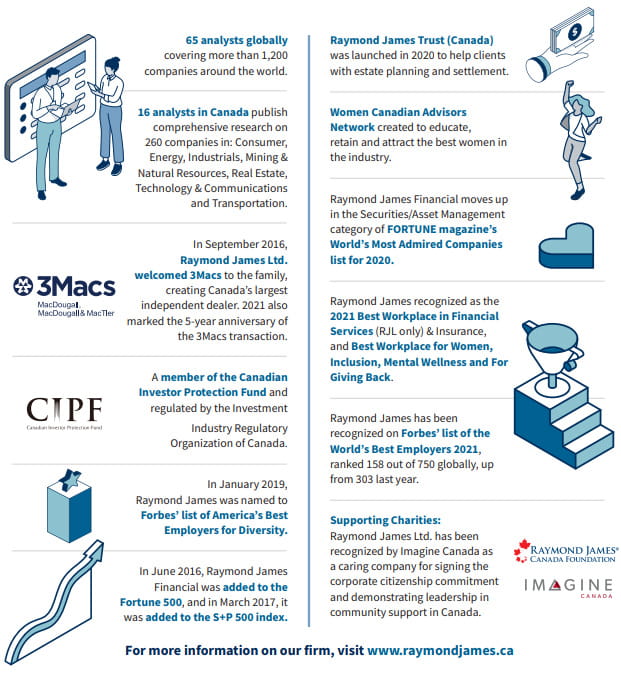

Our numbers are impressive, but our people are our greatest strength. In Canada and across our network, we share a vision of delivering the highest level of wealth management advice by always focusing on the unique needs of each client and their families. This client-first focus is further underscored by our core values of professional integrity, advisor independence and a conservative, long-term approach to investing.

Our Company

By consistently putting the needs of our clients first, Raymond James has become one of Canada’s premier independent investment firms. Our client focus and the strength of over 1,637 employees and agents in Canada have garnered us many of the industry’s top honours.