The Importance of Adequate Life Insurance

Adam McHenry, CFA, MBA

Portfolio Manager, Raymond James Ltd.

Greetings! I am Adam McHenry, a Financial Advisor at Langill and McHenry Investment Advisors at Raymond James Ltd., with CFA and MBA designations. Today, I’d like to offer a brief guide to life insurance - a crucial yet often underappreciated component of personal finance.

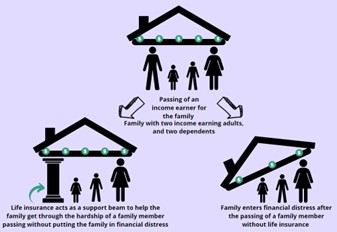

Life insurance is more than a financial safeguard. It is a proactive financial tool for ensuring the financial well-being of your loved ones and fulfilling your financial responsibilities, even in your absence.

To better illustrate the importance of life insurance, let’s consider a hypothetical scenario:

John and Jane, both 35 years old, have two children aged five and seven. John, the primary breadwinner, earns $100,000 annually. They are committed to a $300,000 mortgage and a combined $50,000 in car loans and credit card debt. In the unfortunate event of John’s sudden passing, Jane would be confronted with not only immediate final expenses, which typically range between $10,000 and $15,000, but also a significant reduction in household income. Such circumstances would make it challenging for her to manage everyday expenses and pay off outstanding debts. However, having a term life insurance policy that offers a death benefit of $1,000,000 could replace John’s income for approximately ten years, enabling Jane to manage their debts effectively and secure provisions for their children’s future education.

The types of life insurance each vary with its unique features. Here’s a quick rundown:

- • Term Life Insurance: This policy provides coverage for a specified term, typically between 10 to 30 years. If the policyholder passes away during this term, the death benefit is paid out to the beneficiaries.

- • Whole Life Insurance: A type of permanent life insurance, it provides coverage for the entire lifetime of the insured. Additionally, it builds up cash value over time, which can be borrowed against.

- • Universal Life Insurance: This permanent insurance offers a cash value component along with more flexibility in terms of premium payments and death benefits.

Choosing the right life insurance requires understanding your unique needs, and an insurance-licensed financial advisor can be instrumental in this process. They can help you consider several factors including:

- • Income replacement: The years of income you’d want to replace to maintain your family’s current lifestyle.

- • Debts: The amount needed to settle your mortgage, car loans, personal loans, and any other outstanding debts.

- • Future expenses: Major costs such as your children’s education or your spouse’s retirement.

- • End-of-life expenses: The average cost of a funeral and other related expenses can add up quickly.

When considering the cost of life insurance, these factors come into play:

- • Age: Premiums generally increase with age.

- • Health: Your health status is assessed, with healthier individuals generally receiving lower premiums.

- • Lifestyle: High-risk behaviours like smoking or dangerous hobbies can increase your premiums.

- • Type of insurance: Term insurance usually costs less than permanent life insurance.

- • Coverage Amount: Policies with larger death benefits come with higher premiums.

- • Sex/ Gender: Certain gender-related factors, such as average life expectancy and mortality rates, are taken into account when determining premiums.

In summary, life insurance is an integral part of a comprehensive financial plan. It’s about the legacy and financial security you aim to provide for your loved ones. As you navigate your financial future, I recommend consulting with a licensed insurance advisor who can assist in determining the right type and amount of life insurance coverage that suits your unique circumstances.

If you wish to further discuss life insurance or any other financial matter, please feel free to contact me at Langill and McHenry Investment Advisors at Raymond James Ltd.

For a complimentary consultation call 416-901-6500 or email adam.mchenry@raymondjames.ca. For more information about our complete list of services and how we can help you achieve your financial goals, please visit www.adammchenry.com.