Implications of Selling Canadian Real Estate as a Non-Resident of Canada

UPDATE #1:

The below article was originally published on March 5, 2024, and has

been updated to reflect a few key changes following the April 16, 2024,

Federal Budget.

- A key change is the increase of the capital gains inclusion rate from 50% to 2/3 for capital gains in excess of $250,000 for transactions closing on June 25, 2024, onward.

- The first $250,000 of capital gains will still benefit from the 50% inclusion rate for individuals.

- Another important change is that the withholding tax on non-depreciable property will be increased from 25% to 35% from January 1, 2025, onward to reflect the higher capital gain inclusion rate.

- Please see the following Raymond James article for more details about the changes to capital gains: Planning for Changes to Taxation of Capital Gains .

UPDATE #2:

On January 31, 2025, the Minister of Finance announced the federal government is deferring the implementation date of the proposed increase to the capital gains inclusion rate from June 25, 2024 to January 1, 2026. Click here for further details on this announcement.

Congratulations, you are looking to sell your Canadian property and hopefully will walk away with some fruitful gains. But apart from the excitement from the sale, it’s crucial to understand your tax obligations and potential planning opportunities to minimize taxes to Canada. Raymond James has a team of experienced tax consultants and accountants who can assist you with understanding the matters explained in this article and complete the required tax filings.

Tax Residency

The following matters will apply to you if you are a non-resident of Canada for income tax purposes. Tax residency is not always a black or white matter, and individuals should always ensure they consult with a qualified cross-border tax professional as it relates to residency matters, especially when large transactions are involved. Missed or late tax filings could result in substantial penalties and interest, so it is always best to be prepared.

The CRA’s Income Tax Folio S5-F1-C1, Determining an Individual’s Residence Status is a comprehensive resource that discusses tax residency. While tax residency is not defined in the Income Tax Act, it has been tested by the courts and crucial factors include whether an individual has significant primary and secondary ties to Canada. Primary ties to Canada include a home available for their use in Canada, even if the individual still lives abroad. Therefore, if someone is living abroad and still has their home in Canada, they may still be considered a tax resident at the time of sale. Income tax treaties that Canada has with foreign countries may help address residency matters when an individual is considered a tax resident of two countries under each country’s domestic rules by providing tie-breaker rules.

Non-Resident Withholding

Under Canadian tax rules, Canada has the right to tax the sale of real property located in the country. To ensure the CRA has sufficient security to cover the tax liability, should a non-resident individual choose not to comply with their tax filings, they have a non-resident tax withholding process in place. However, the tax withholding is not the final tax liability, as will be explained further in this article.

If an individual is factually a non-resident when disposing of Canadian real estate, there are specific rules in place that may come as a surprise to unsuspecting individuals. If someone has previously sold their home in Canada as a Canadian tax resident, the transaction may have been relatively straight forward, with sellers receiving their proceeds post-closing costs and mortgage balance, within a business day or two of closing. However, as a non-resident of Canada, sellers should anticipate additional administrative steps and delays with receiving their full proceeds.

Non-resident buyers are required to withhold 25% of the gross proceeds of the home (or 50% in the event of selling depreciable property, such as a building used as a rental building). For transactions closing on or after January 1, 2026, the withholding tax will increase from 25% to 35% to account for the increase in the capital gain inclusion rate following the 2024 Federal Budget changes.

Generally speaking, the seller’s real estate lawyers will hold these proceeds in trust. This withholding amount is held in trust until a Certificate of Compliance, Form T206 4 or T2068 is received from the CRA . It is crucial that non-resident sellers work closely with qualified real estate lawyers and accountants who are familiar with such transactions.

The application for the Certificate of Compliance, Form T2062 has to be made within 10 days of the closing of the property. Late filing penalties of $25 per day apply, up to a maximum of $2,500 per seller. Generally, this form is prepared by a qualified tax accountant.

The Form T2062 application provides detailed information about the property, buyer and seller of the transaction. To file a T2062, one must have a Canadian Tax ID, therefore if they don’t already have a SIN or ITIN, they would apply for a Canadian Tax ID using Form T1261.

The Form T2062 calculates tax that is owed to the CRA, which is generally 25% (or 35% for transactions on or after January 1, 2026) of the capital gain, after consideration of the principal residence exemption, if available to a former tax resident. Upon the CRA sending the T2064 or T2068 Certificate of Compliance, the real estate lawyer would release the difference between the 25%, 35% or 50% of gross proceeds withheld and the tax withholding calculated in the T2062.

Important - CRA processing times for the T2062 Request for Certificates of Compliance are significant, and could take 8-12 weeks, if not longer. It is generally in taxpayer’s best interest to file the T2062 as soon as possible and not wait for the 10-day post-close deadline. Ideally, the CRA will provide the Certificate of Compliance by closing date of the sale. Otherwise, sellers will have to wait to receive their post-tax proceeds for weeks/months. This may tie up needed resources, such as down payments for subsequent property purchases.

What if the home was a principal residence?

If the home was a principal residence (“PR”) of the non-resident during the ownership period, the principal residence exemption could still apply to reduce the gain subject to the 25% federal tax withholding (and the gain ultimately subject to tax upon filing the tax return, as discussed further in this section).

Generally speaking, the principal residence exemption (“PRE”) is limited by reference to the number of tax years after the acquisition date during which the taxpayer was a resident in Canada. Therefore, if someone sold their Canadian home that they lived in as a tax resident, after they ceased Canadian tax residency, the principal residence exemption could still be available.

The PRE rules stipulate that to designate one’s home as a PR for a given year of ownership, they must have “ordinarily inhabited it” at some point during the year in question. Canadian tax rules do not indicate a minimum period for which the individual has to ordinarily inhabit the home in a given year, it is just important to note that only 1 PR can be designated each year. So, for example, an individual may have lived in their Canadian home for the first two weeks of January of 2024 before ceasing tax residency on January 16, 2024, and moving to a different home outside of Canada on the same day. They may still be able to designate this Canadian home as their PR for the 2024 year.

What if I sold my PR the year after I ceased Canadian residency?

When calculating the PRE – i.e., the portion of the gain that is exempt from income, the formula is as follows:

Taxpayer's gain

X

Numbers of years the property was the taxpayer's PR + 1

Number of years the taxpayer owned the property

With the “+1” rule, this allows an individual to designate a property as their PR for one additional year. Note that this +1 rule does not apply to taxpayers who were non-residents during the year the property was originally purchased. Therefore, as used in the earlier example where the individual ceased tax residency on January 16, 2024, they may still be able to claim the full PRE on their gain if they sold the home in 2025.

Because of the PRE formula, as the years of ownership increase following the years that the taxpayer used the home as a PR during their Canadian residency period, the percentage of gain that will be sheltered by the PRE will decrease annually.

From a planning perspective, to maximize the PRE on a home that was used as their PR before moving out of Canada, non-resident taxpayers can plan to dispose of the property by the end of the calendar year following the year they ceased Canadian tax residency.

Tax Filing Obligations

Non-residents are required to file a non-resident Form T1, Individual Income Tax Return by April 30 of the year following the year of property disposition. The tax return calculates tax at marginal tax rates on the taxable capital gain.

The taxable capital gain also takes into account outlays and expenses with the disposition, including legal and accounting fees and realtor commissions. Therefore, the capital gain calculated in the Form T1 may be less than the amount on the T2062, as the T2062 capital gain does not take into account these closing costs.

If the tax calculated on the Form T1 is less than the tax remitted to the CRA with the T2062, then the difference is refunded to the taxpayer.

Quebec Considerations

Non-residents who sell real property located in Quebec will have a separate clearance certificate and tax filing requirement with Revenu Quebec. In addition to the T2062, taxpayers will have to apply for form TP-1097-V within the same 10-day post-close deadline with Revenu Quebec, and will be subject to the same $25/day, up to a maximum of $2,500 penalty for late filing.

The withholding amount required for the sale of Quebec property is 12.875% on the gain, after exemptions, such as the principal residence exemption. This means that on the sale of a Quebec property by a non-resident, taxpayers would have a combined federal and Quebec tax remittance requirement of 37.875% on the capital gain.

In addition, taxpayers will have to file a Form TP-1-V, Income Tax Return, with Revenu Quebec, where the final tax is calculated using marginal rates.

Other Considerations

- Rental Property – if a non-resident sells Canadian real estate that was used as a rental property, there are additional considerations. Taxpayers must file for a T2062-A regarding the sale of depreciable capital property. If there is recapture of CCA from the sale of the property, this tax must also be remitted to the CRA as part of the clearance certificate process.

- Joint Property – if the non-resident jointly owns the property, each joint owner must submit the application for the clearance certificate and tax returns.

- Resident country taxation – consider how the home country will tax the sale of the Canadian property. This will have to be confirmed by a tax professional in the country of residence.

Comprehensive Example – Canadian Tax

Mr. Jones ceased Canadian tax residency on December 31, 2021, when he moved south to the U.S.

Mr. Jones purchased his home in 2015, located in Ontario, for $500,000 and used it as his principal residence up until his residency end date.

The home was kept vacant after his move and not used as a rental property. He listed the property in January 2024.

He accepted an offer on February 5, 2024, for $750,000 and the closing date of the sale is April 28, 2024. Closing costs, including realtor commissions, legal fees, and accounting fees totalled $60,000.

In 2024, Mr. Jones had no other source of Canadian income reportable on a non-resident Canadian tax return.

Steps:

- Mr. Jones retained a qualified tax accountant from the Raymond James tax preparation team and a real estate lawyer who are both familiar with non-resident real estate transactions. In early January 2024, Mr. Jones started working with his tax accountant to gather documents required for the T2062 application, so that as soon as an accepted offer comes through, the application can be filed.

-

Upon receiving an accepted offer on February 5, 2024, Mr. Jones’

accountant immediately filed a T2062 application with the CRA, along

with Form T2091 - Designation of a Property as a Principal Residence by

an Individual and other supporting documentation.

Of the total 10 years the property was owed by Mr. Jones, he was able to designate the property as his principal residence for 7 years, plus receives one “bonus year”. Therefore, 8/10 years, or 80% of the gain is exempt using the Principal Residence Exemption.

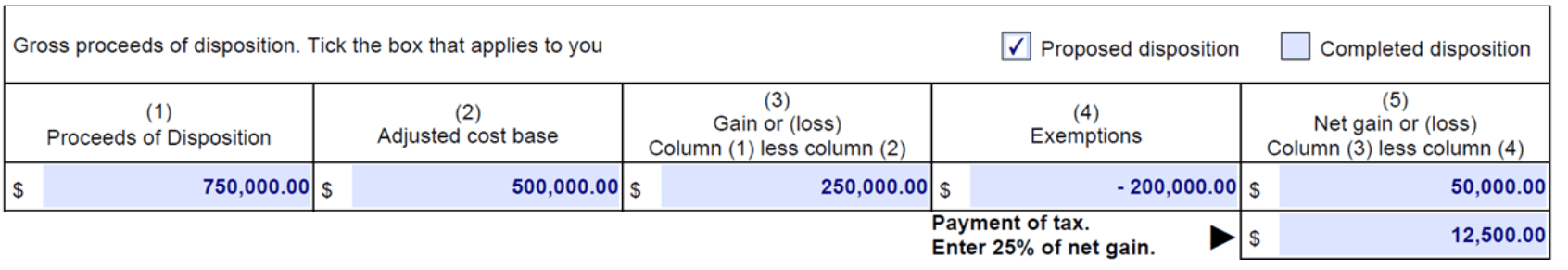

The T2062 included the following excerpt under the ‘Details of property” section.

-

At the time of closing on April 28, 2024, the amount that the Mr. Jones

receives is dependent on whether the CRA has issued the T2064,

Certificate of Compliance yet. If not, then generally speaking, the

seller’s lawyer would hold 25% of the gross proceeds (750,000 x 25% =

$187,500) in trust until receipt of the T2064. The seller would then

receive their cash proceeds net of this non-resident tax withholding and

any other closing costs and mortgage obligations.

If for example, the T2064 is received from the CRA following the closing, such as on May 15, 2024, the lawyer would release the difference between the withheld amount and the tax calculated in the T2062 ($187,500 - $12,500 = $175,000).

In an ideal scenario, the application for the certificate of compliance would be filed well in advance of closing and the CRA would process the T2062 ahead of the April 28, 2024, closing date. This would allow the seller to not have as significant of an amount of their proceeds held in trust and limit the tax withholding to the $12,500. - Mr. Jones files a 2024 Canadian tax return, reporting the disposition of the property on Schedule 3 of the tax return and filing the T2091. Failure to file the T2091 to designate the property as the principal residence may result in significant penalties. The outcome of the tax return is as follows:

| Proceeds of Disposition | $ 750,000 |

| Less: Adjusted Cost Basis | - 500,000 |

| Less: Outlays and Expenses | - 60,000 |

| Capital Gain | $ 190,000 |

| Less: Principal Residence Exemption (PRE) | - 152,000 |

| Capital Gain after PRE | 38,000 |

| Taxable Capital Gain (50% Taxable Portion) | $ 19,000 |

| 2024 Taxable Income | 19,000 |

| Federal Tax - 15% of Taxable Income* | 2,850 |

| Non-Resident Federal Surtax (48% of Federal Tax) | 1,368 |

| Total Canadian Tax Liability | $ 4,218 |

| Less: Tax Withholding with T2062 | - 12,500 |

| Tax Refund | -$ 8,282 |

| * 15% is the federal marginal tax rate for taxable income below $55,867 in 2024. | |

- Therefore, based on a total capital gain of $190,00 after closing costs, Mr. Jones had a final Canadian tax liability of $4,218, due to the use of the principal residence exemption on part of the property sale.

Conclusion

It is important to ensure that when individuals are planning to sell Canadian property as a non-resident, they engage a tax accountant as early as possible in the process, to reduce the risk of significant delays which may tie up cash flows from the property sale. On the bright side, non-residents can still benefit from the tax advantages of selling Canadian real estate, including the reduced inclusion rate for capital gains, marginal tax rates, and the principal residence exemption. If you have questions about the sale of your Canadian property and how it may impact your overall financial standing, speak to your Raymond James financial advisor.

This has been prepared by the Total Wealth Solutions Group of Raymond James Ltd., (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities nor is it meant to replace legal, accounting, taxation or other professional advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The information is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. This is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., Member - Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a Member - Canadian Investor Protection Fund.